At a Glance

- Standard Bank trims its Trencor stake from 5.36% to 3.92% after shares plunged 88%, reducing its investment from over $4 million to less than half of a billion dollars.

- CoroCapital also cut its stake, while Cuthman Capital increased its holding to 30.88%, highlighting diverging investor strategies amid Trencor’s sharp decline.

- Despite market uncertainty, Trencor declared a rare R7.30 ($0.4) dividend, its first since 2014, raising questions about the company’s financial strategy and long-term outlook.

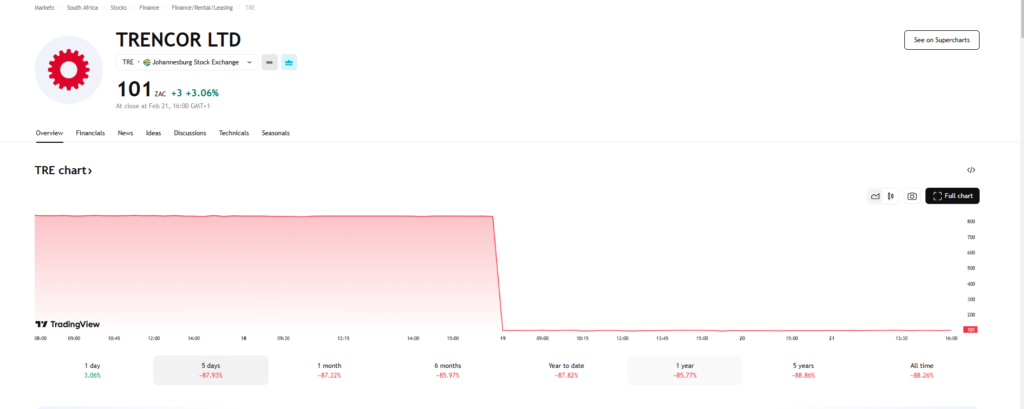

Standard Bank Group, Africa’s largest lender by assets, has significantly trimmed its stake in JSE-listed Trencor Limited after the investment holding company’s stock suffered a staggering 88 percent decline.

The Johannesburg-based financial giant, reduced its holding from 5.36 percent to 3.92 percent, slashing its total investment from more than $4 million to less than $500,000.

Market turmoil and portfolio rebalancing

The decision to trim its stake in Trencor, disclosed on February 20, 2025, follows a brutal selloff that saw the cash company’s share price collapse from R8.34 ($0.46) to R0.98 ($0.053) in under four days, erasing its market capitalization by more than $68 million to less than $10 million.

A regulatory filing dated February 14, 2025, had previously indicated Standard Bank’s increased stake in Trencor, then valued at R76.65 million ($4.2 million). However, the subsequent share price nosedive forced a reassessment of its exposure.

By February 18, as shares plunged below R1 ($0.055), Standard Bank trimmed its holding to 3.92 percent, now worth just R6.66 million ($360,000).

The sharp reduction underscores the broader volatility gripping South African equity markets and shifting risk tolerance among institutional investors.

Institutional investors take diverging paths

Standard Bank isn’t alone in reassessing its Trencor exposure—CoroCapital also slashed its stake from 8.98 percent representing R128.42 million ($7 million) to just 1.36 percent which now amounts to R2.31 million ($130,000).

Conversely, Cuthman Capital Proprietary Limited seized the opportunity to ramp up its stake, increasing its holding from 4.54 percent, previously worth R64.92 million ($3.54 million) to a commanding 30.88 percent position valued at R52.5 million ($2.86 million). This stark contrast in strategy highlights differing outlooks on Trencor’s long-term prospects amid extreme market turbulence.

Dividend payout amid uncertainty

Despite the precipitous stock decline, Trencor announced a dividend of R7.30 ($0.40) per share, a rare payout for shareholders who purchased stock before February 19, 2025. Last year December, the cash company was considering winding up amid its many woes.

The dividend, set for distribution on February 24, 2025, marks the company’s first ordinary payout since 2014. It comes at a time when the industry’s average dividend yield stands at 6.6 percent, raising questions about the sustainability of such a move given Trencor’s current market challenges.

Standard Bank’s broader strategy

Standard Bank remains Africa’s dominant corporate financier, with a market capitalization of R364 billion ($19.84 billion) and operations spanning 19 sub-Saharan African countries, including Uganda, Tanzania, Kenya, South Sudan, and Ethiopia. Its decision to pare back exposure to Trencor reflects a cautious recalibration in response to sharp market swings.

As institutional investors navigate an increasingly volatile environment, the contrasting approaches to Trencor underscore the broader challenges facing South Africa’s corporate sector. The divergence in investor sentiment—some retreating while others double down—suggests that the future of Trencor remains anything but certain.