At a Glance

- Allan Gray increased its stake in African Rainbow Minerals to 5.1793%, now worth $96.2 million, reinforcing its long-term confidence in South Africa’s mining sector.

- ARM’s earnings plunged 48.6% year-over-year, hit by weak commodity prices and rising costs, with its PGM division suffering a $37.82 million headline loss.

- The investment firm’s move signals optimism for ARM’s resilience, even as regulatory filings confirm compliance with JSE rules and South Africa’s Companies Act.

Allan Gray, an investment management firm headquartered in South Africa, has deepened its investment in African Rainbow Minerals (ARM), the diversified mining group controlled by South African billionaire Patrice Motsepe. This reinforces its commitment to the country’s consumer healthcare sector.

The move, disclosed in a regulatory filing on March 7, 2025, underscores Allan Gray’s strategic position in South Africa’s mining industry.

The firm’s latest acquisition adds 1.829 percent, representing an additional 4,126,659 shares to its existing holdings, bringing its total stake to 5.1793 percent of ARM’s issued ordinary shares.

Allan Gray boosts stake amid ARM’s declining profitability

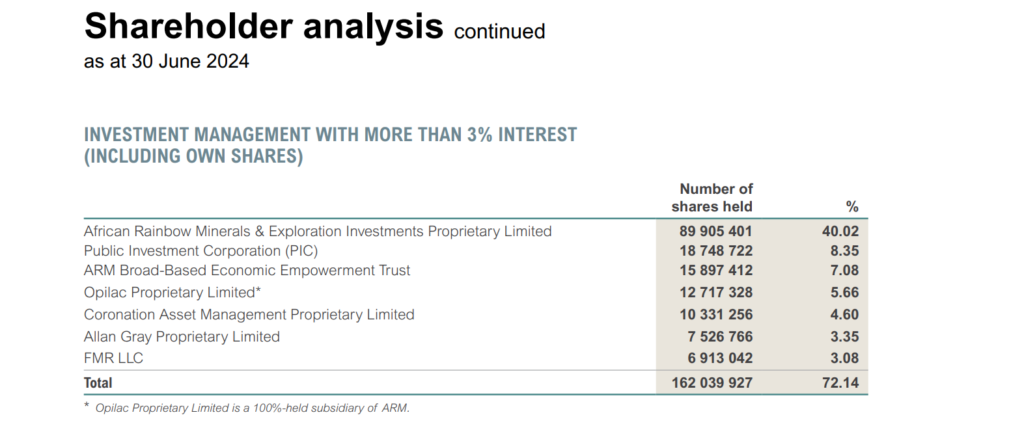

Allan Gray’s latest share purchase raised its holdings in ARM from 3.35 percent— amounting to 7,526,766 ordinary shares as of June 30, 2024—to 5.1793 percent, worth R1.76 billion($96.16 million).

This 1.8293 percentage -point increase solidifies Allan Gray’s position as one of the largest shareholders in ARM.

ARM, a leading diversified miner with interests spanning iron ore, manganese, platinum group metals (PGMs), and coal, has faced significant pressure from weakening commodity prices and mounting operational costs.

The group’s earnings for the first half of the 2025 fiscal year plummeted to R1.52 billion ($83.43 million), down from R2.96 billion ($162.2 million) in the prior-year period.

The mining giant has struggled amid sluggish off-take from key customers, such as ArcelorMittal South Africa, and declining iron ore and PGM prices.

ARM Platinum, which includes the Bokoni, Two Rivers, and Modikwa mines, recorded a deepened headline loss of R689 million ($37.82 million) due to persistently low PGM prices and escalating mechanized development costs at Bokoni.

Despite these challenges, Allan Gray’s increased investment suggests confidence in ARM’s long-term value, possibly anticipating a sector recovery or strategic operational adjustments.

Regulatory compliance and corporate governance

Following the acquisition, ARM has filed regulatory notices with the Takeover Regulation Panel and the Companies and Intellectual Property Commission, ensuring compliance with South Africa’s Companies Act and Johannesburg Stock Exchange (JSE) listing requirements.

The company’s board has affirmed the accuracy of the disclosure, maintaining transparency in shareholder updates.

As global mining markets continue to navigate volatility, Allan Gray’s investment move reflects a strategic bet on ARM’s ability to weather commodity price cycles and operational headwinds, reinforcing the asset manager’s role as a key institutional investor in South Africa’s resource sector.