At a Glance

- Egypt’s REITs drive real estate growth with over $46 billion in listed market value.

- EGX-listed developers focus on housing, hospitality, and commercial real estate expansion.

- REITs in Egypt offer diversified exposure to residential, tourism, and mixed-use projects.

Egypt’s real estate sector is fast evolving into an institutional-grade investment landscape, powered by a dynamic Egyptian Exchange (EGX) that has grown into one of Africa’s most influential capital markets.

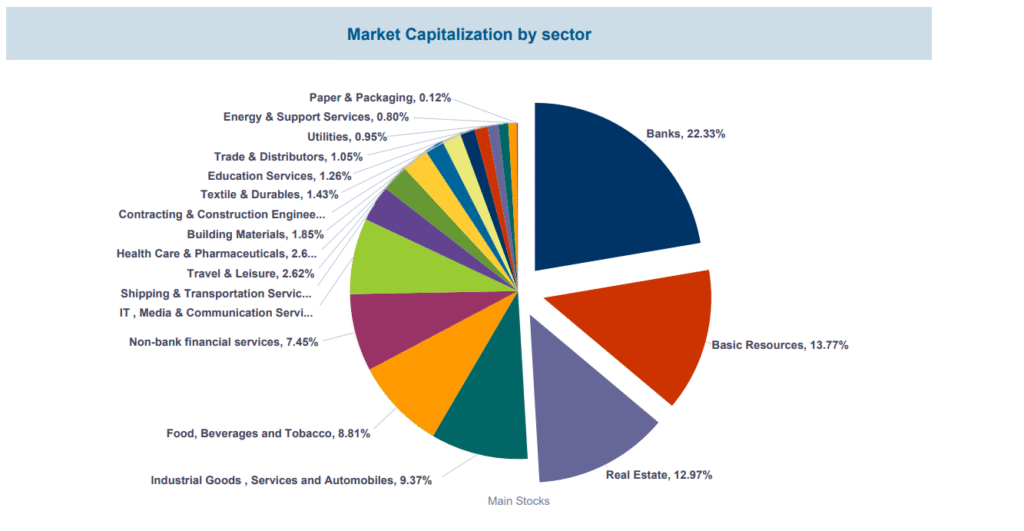

With a total market capitalization of EGP2.31 trillion ($46.54 billion), EGX plays a pivotal role in capital formation, driving growth in key sectors such as construction, financial services and real estate, which make up about 12.79 percent of the entire valuation.

As urbanization intensifies and the middle class expands, Egypt’s listed real estate firms—many structured as REITs or REIT-like entities—are gaining traction among income-seeking investors.

These firms offer exposure to residential, commercial, and mixed-use developments, aligning with Egypt’s infrastructure ambitions and growing housing demand.

While South Africa leads Africa’s REIT market, Egypt is emerging as a key frontier, leveraging its macroeconomic reforms, capital market maturity, and robust sectoral demand.

Shore Africa spotlights the top 15 publicly listed real estate investment platforms on the EGX, shedding light on their market size, development focus, and strategic role in shaping Egypt’s built environment.

1. Talaat Moustafa Group (TMG) Holding

Market Cap.: EGP117.38 billion ($2.37 billion)

Geographic focus: Egypt and North Africa.

Property portfolio: Develops large-scale mixed-use communities, residential complexes, and hotels.

Brief details: TMG Holding, with valuation worth EGP117.38 billion ($2.37 billion), is a prominent Egyptian conglomerate with diversified interests in real estate development, tourism, and hospitality, leveraging its expertise to create iconic projects that showcase Egypt’s rich cultural heritage, while driving economic growth and job creation. The company is owned by Hisham Talaat Moustafa.

2. Emaar Misr for Development

Market Cap.: EGP51.15 billion ($1.03 billion)

Geographic Focus: Cairo and surrounding areas.

Property Portfolio: Develops large-scale residential and commercial properties in Egypt.

Brief details: Emaar Misr for Development, with a market capitalization of EGP51.15 billion ($1.03 billion), is a leading Egyptian real estate developer, creating iconic projects, including residential communities, commercial centers, and hospitality developments, showcasing Egypt’s rich cultural heritage and driving economic growth.

3. Palm Hills Developments

Market Cap.: EGP23.73 billion ($478.16 million)

Geographic focus: Egypt, with expansions into North Africa.

Property portfolio: Specializes in luxury residential communities and commercial properties.

Brief details: Palm Hills Development Company, with EGP23.73 billion ($478.16 million) valuation, is a prominent Egyptian real estate developer, creating iconic projects, including residential communities, commercial centers, and hospitality developments, driving economic growth and development in Egypt.

4. SODIC – Sixth of October Development and Investment Company

Market Cap.: EGP23.01 billion ($463.67 million)

Geographic Focus: Egypt.

Property Portfolio: Specializes in luxury residential and commercial properties.

Brief details: Six of October Development&Investment (SODIC), with EGP23.01 billion ($463.67 million) valuation, is a prominent Egyptian real estate developer, creating iconic projects, including residential communities, commercial centers, and hospitality developments, driving economic growth and development in Egypt.Market Capitalization: EGP 21.89 billion ($432.58 million)

5. Heliopolis Housing and Development

Market Capitalization: EGP13.75 billion ($277.08 million)

Geographic focus: Cairo and surrounding areas.

Property portfolio: Specializes in residential and commercial developments.

Brief details: One of Egypt’s oldest developers, Heliopolis Housing, with a market valuation of EGP13.75 billion ($277.08 million) leverages extensive land holdings to deliver large-scale urban projects, including the New Heliopolis City, aligning with national housing expansion plans.

6. Madinet Nasr Housing & Development

Market Cap.: EGP9.69 billion ($195.31 million)

Geographic focus: Greater Cairo and New Cairo

Property portfolio: Master-planned urban communities, mixed-use residential and commercial developments

Brief details: A pioneer in Egypt’s housing sector, Madinet Nasr Housing & Development delivers large-scale urban projects like Taj City and Sarai, catering to mid-to-high income segments.

7. Egyptian Resorts Company

Market Capitalization: EGP8.5 billion ($171.17 million)

Geographic focus: Egyptian coastal regions.

Property portfolio: Focuses on tourism-driven real estate developments.

Brief details: Egyptian Resorts Company, with a market valuation of EGP8.5 billion ($171.17 million), specializes in developing integrated coastal communities. Its flagship project, Sahl Hasheesh, positions ERC as a key player in Egypt’s luxury tourism and real estate market.

8. Zahraa Maadi Investment & Development

Market Cap.: EGP3.74 billion ($75.36 million)

Geographic focus: Maadi and surrounding suburbs

Property portfolio: Residential units, land banking, and infrastructure development

Brief details: Zahraa Maadi focuses on developing residential real estate in Cairo’s southern suburbs, leveraging its extensive land holdings to create value-driven housing projects.

9. Arab Developers Holding

Market Cap.: EGP3.18 billion ($64.15 million)

Geographic focus: Egypt and selected MENA markets

Property portfolio: Mixed-use urban developments, retail, and hospitality projects

Brief details: Arab Developers Holding positions itself as a regional player, combining real estate, tourism, and commercial investments with a focus on integrated lifestyle communities.

10. A Capital Holding

Market Cap.: EGP2.6 billion ($52.39 million)

Geographic focus: Egypt-wide, with a mix of urban and suburban holdings

Property portfolio: Diversified real estate, investment projects, and land development

Brief details: A Capital Holding operates across Egypt’s real estate value chain, engaging in development, asset management, and investment advisory services in property and infrastructure.

11. El Kahera Housing & Development

Market Cap.: EGP2.07 billion ($41.72 million)

Geographic focus: Greater Cairo and satellite cities

Property portfolio: Residential compounds, commercial units, and industrial plots

Brief details: El Kahera Housing has a long-standing presence in Egypt’s urban expansion, delivering affordable to mid-income housing projects and contributing to state-led development plans.

12. El Shams Housing & Development

Market Cap.: EGP1.86 billion ($37.49 million)

Geographic focus: Cairo and Giza

Property portfolio: Residential buildings, apartments, and infrastructure

Brief details: With decades in Egypt’s real estate landscape, El Shams Housing delivers cost-effective residential units and is known for its strategic land investments and urban housing initiatives.

13. Egyptians Housing & Development

Market Cap.: EGP1.33 billion ($26.74 million)

Geographic focus: Nationwide urban centers

Property portfolio: Residential and low-rise commercial properties

Brief details: Egyptians Housing focuses on small to mid-scale real estate projects, offering affordable housing solutions and participating in national urban development schemes.

14. Amer Group Holding

Market Cap.: EGP1.29 billion ($26.01 million)

Geographic focus: Coastal cities and new urban communities

Property portfolio: Resort developments, commercial malls, and residential compounds

Brief details: Known for iconic projects like Porto Marina and Porto Sokhna, Amer Group combines hospitality and residential real estate, targeting Egypt’s growing leisure property market.

15. Mena Touristic & Real Estate Investment

Market Cap.: EGP1.22 billion ($24.57 million)

Geographic focus: Cairo, Red Sea, and tourist areas

Property portfolio: Hotels, resorts, and coastal residential properties

Brief details: Blending tourism with real estate, Mena Touristic develops hospitality-driven projects, supporting Egypt’s tourism economy while offering residential options in resort zones