At a Glance

- TMG adds $400 million to valuation amid record-breaking SouthMED sales in Egypt’s North Coast.

- The developer leads African market with over $19.7 billion in lifetime real estate sales.

- Expanding in Saudi Arabia and Oman boosts forex inflows, shielding against currency volatility.

Cairo-based property powerhouse Talaat Moustafa Group Holding (TMG), led by billionaire Hisham Talaat Moustafa, has added over $400 million to its market value in 2025—cementing its dominance as Africa’s most valuable listed real estate developer.

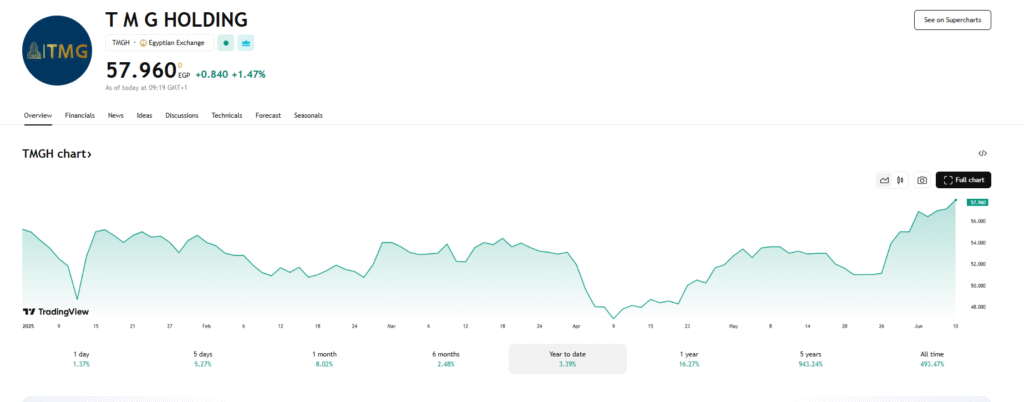

TMG’s valuation briefly dipped below $2 billion in January, when its share price fell to EGP 48.7 ($0.984). Since then, the company has rebounded sharply, fueled by record-breaking sales, regional expansion, and strategic developments such as its SouthMED coastal megaproject.

As of June 2025, TMG’s share price on the Egyptian Exchange(EGX) has risen 3.52 percent year-to-date, pushing its market capitalization to EGP 119.62 billion ($2.41 billion). The firm’s real estate sales hit EGP 160 billion ($3.16 billion) in the first quarter—marking a 127 percent year-on-year increase and a new benchmark for Egypt’s property sector.

TMG records sales surge

TMG stunned the market with its launch of SouthMED Phase 2, generating EGP 70 billion ($1.38 billion) in sales within a single day by selling more than 5,100 units. The project has now reached cumulative sales of EGP 352 billion ($6.95 billion) since its debut in July 2024.

With this, TMG has officially crossed the EGP 1 trillion ($19.76 billion) mark in cumulative real estate sales—solidifying its position as the nation’s undisputed market leader.

Regional expansion shields against FX volatility

TMG’s valuation surge also reflects its successful geographic diversification. Following its Banan project in Saudi Arabia, the company is now expanding into Oman to replicate its “smart city” development model. These cross-border plays provide a natural hedge against the Egyptian pound’s depreciation and boost its foreign exchange earnings.

Since 2017, TMG has recorded a compound annual growth rate (CAGR) of over 70 percent in real estate sales. It now commands more than 50 percent of total sales among Egypt’s top ten developers in a sector contributing over 20 percent to national GDP.

A scaled model for high-margin growth

Founded in 1974, TMG is now the country’s largest developer by both market share and delivery capacity. CEO Hisham Talaat Moustafa, who owns 43.16 percent of the group, has steered the firm with a long-term strategy focused on high-margin, asset-light growth. TMG’s pipeline of self-sustaining, smart urban communities integrates upscale living with world-class infrastructure and sustainable development.

SouthMED—spanning 23 million square meters on Egypt’s North Coast—is a cornerstone of this strategy. The mixed-use development includes luxury villas, a marina, golf courses, and more than 2,000 hotel rooms managed by international hospitality brands.

Aggressive marketing has supported the brand’s high-end positioning. Cinematic ad campaigns featuring global icons Sylvester Stallone and Thierry Henry have brought international attention to SouthMED.

Africa’s rising REIT-style giant

While not a formal REIT, TMG’s consistent returns, recurring income model, and portfolio scale place it in league with the continent’s top property investment firms. It ranks second in Africa by market value and leads the Middle East in publicly listed developer sales.

With its expanding hospitality unit, Legacy Hotels, and new regional developments on the horizon, TMG continues to redefine the standard for scale, speed, and profitability in African real estate.