At a Glance

- PIC cuts Astral stake below 25% amid agribusiness volatility and weak poultry margins.

- Astral struggles with profit drops from bird flu, power cuts, and feed inflation.

- New investors show cautious optimism despite Astral’s fragile post-loss recovery trajectory.

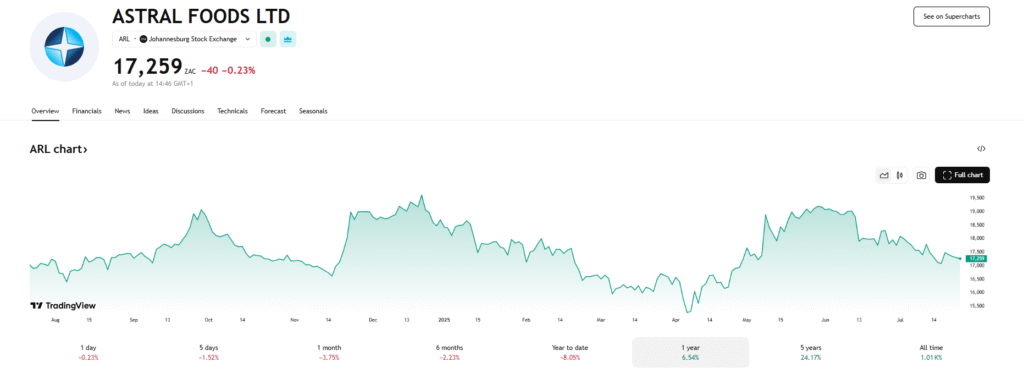

The Public Investment Corporation SOC Ltd. (PIC), Africa’s largest asset manager and the guardian of South African government pension funds, has reduced its stake in Astral Foods Ltd. from over R2 billion ($115 million) to 23.94 percent, according to a regulatory filing on July 23.

The move marks a significant recalibration of its holdings in one of South Africa’s biggest poultry producers, amid a challenging operating environment.

Strategic pullback from a volatile sector

The Pretoria-based asset manager disclosed the move in line with regulatory obligations, confirming that its beneficial interest in Astral Foods declined from 26.97 percent as of February 20, 2025, to R1.78 billion ($101.34 million) in value—now below the pivotal 25 percent threshold.

The reduction marks a significant repositioning that reflects tempered confidence in the near-term prospects of South Africa’s agribusiness sector.

Margins squeezed by load-shedding, Bird Flu

Astral, a vertically integrated poultry leader, has been navigating a tough operating landscape marked by prolonged power outages, water shortages, and surging feed costs.

For the six months to March 2025, Quantum Foods posted a 3.5 percent revenue rise to R10.7 billion ($609.98 million), led by feed and poultry sales, but profits fell 50.7 percent as poultry prices weakened despite a 4.4 percent rise in volumes. The poultry segment swung to a $1.5 million loss, compared to a $16 million profit a year earlier.

Strong cash generation, asset sales, and resumed dividends bolstered finances. The Feed Division saw 9.4 percent revenue growth, offset by raw material cost hikes in Zambia.

That slump followed a full-year net loss of R512 million ($28 million) in 2023, driven by the outbreak of the H7N6 bird flu virus, persistent energy constraints, and record input inflation.

Project 3R: Resetting profitability

To regain financial footing, Astral initiated Project 3R (reset, refocus, restart), a turnaround strategy that delivered early results in 2024. Operating earnings rebounded 461 percent, and revenue improved across its feed and protein segments.

By the fiscal year ended September 2024, the company returned to profitability, posting headline earnings per share of R19.20 ($1.06), up from a loss in the prior year. As of that reporting year, PIC held 22.67 percent equivalent to 9.73 million shares.

Investor reshuffle and asset sales

Shore Africa gathered also how the firm’s ownership profile has also evolved. In mid-2024, Truffle Asset Management acquired a 10.48 percent stake, while Mianzo Asset Management took a 5.16 percent position—signaling renewed investor interest despite ongoing risks. Earlier in the year, Astral divested its 9.8 percent stake in Quantum Foods for R141.7 million ($7.7 million) to support liquidity and preserve key supply agreements.

Broader implications of PIC’s exit

PIC’s reduction underscores a measured de-risking strategy. As the largest institutional shareholder, its move could influence broader investor sentiment toward the food production sector. The shift reflects cautious optimism around Astral’s turnaround but highlights persistent concerns about volatility and systemic infrastructure issues.

Fragile recovery, strategic watchpoints

While Project 3R offers a roadmap for recovery, analysts remain wary. The impact of South Africa’s “two-pot” pension reforms—which could lift disposable incomes—as well as potential interest rate cuts, may support consumer demand in 2025. Still, lingering threats from bird flu recurrence, rising poultry imports, and cyberattacks remain unresolved.

Astral’s future may hinge on how effectively it builds resilience in a fraught operating landscape. PIC’s retreat sets the tone: recovery is underway, but not yet assured.