At a Glance

- PIC invests $330 million, lifting Sibanye stake to 20.2% and deepening local investment strategy.

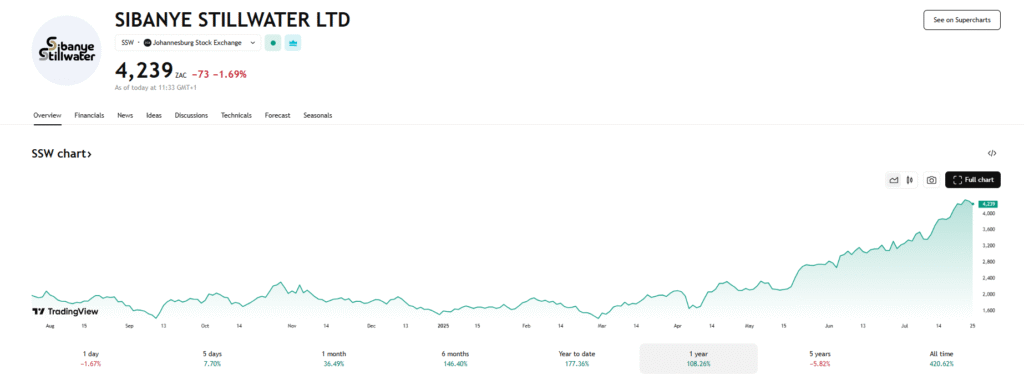

- Sibanye rebounds with gold gains, restructuring ahead of Froneman’s September retirement.

- PIC’s Sibanye move follows $31 million Pepkor investment, affirming SA corporate backing trend.

Africa’s largest asset manager, the Public Investment Corporation (PIC), has bolstered its stake in Sibanye-Stillwater with a $329.61 million share purchase, signaling renewed confidence in the Johannesburg-based mining group.

The move comes shortly after Sibanye acquired U.S.-based precious metals recycler Metallix Refining Inc. for $82 million, marking a significant step toward the circular economy and expanding its North American footprint.

PIC deepens stake in Sibanye

The R5.85-billion ($329.61 million) deal, disclosed on July 25, boosted PIC’s stake in Sibanye from 15.409 percent to 20.203 percent, raising its total investment to R24.65 billion ($1.39 billion).

The move underscores PIC’s continued investment spree in major South African companies. After grappling with slumping prices for platinum group metals (PGMs) and nickel, along with operational challenges, Sibanye has begun to rebound.

A recovery in gold prices and early 2024 restructuring efforts have helped stabilize the company’s performance. The renewed momentum comes as CEO Neal Froneman—who has steered Sibanye through a decade of bold acquisitions and volatile market cycles—prepares to retire in September.

Part of a broader investment strategy

PIC’s latest move goes beyond a single bet on Sibanye—it reflects a broader push to support South African companies with long-term value. Just yesterday, Africa’s largest asset manager injected R548.35 million ($31.11 million) into Christo Wiese-backed Pepkor, lifting its stake from 14.9 percent to nearly 15.5 percent and raising its total investment to over $870 million.

The fresh capital follows a dramatic exit by Ibex Investment Holdings—formerly Steinhoff International—which slashed its Pepkor stake from 28.48 percent to 0.19 percent via a R28-billion ($1.6 billion) accelerated bookbuild.

Shore Africa gathered that PIC has also been steadily increasing its stake in Sibanye. On May 13, it raised its holding from 15.048 percent to 15.409 percent, shortly after the mining group narrowed its 2024 net loss to R5.7 billion ($311 million)—a marked recovery from the $2.03 billion loss a year earlier, triggered by weak commodity prices and asset impairments.

Backing Sibanye through change

Sibanye-Stillwater, a leading global producer of platinum, palladium, and gold, has spent the past decade expanding aggressively under Froneman’s leadership.

The company’s transformation from a gold-focused South African miner into a diversified global player has been closely watched. PIC’s continued support suggests it sees value not just in Sibanye’s recent progress, but in its future beyond Froneman.

Founded in 1911 and corporatized in 2005, the PIC manages pension funds for government workers and oversees more than R3 trillion ($173.27 billion) in assets. As the largest investor on the JSE, it holds more than 10 percent of the JSE’s total market capitalization and is a major shareholder in companies like Investec, Tiger Brands, and Clicks Group.