At a Glance

- Mahloele’s Capitec stake gains $366 million in 115 days as shares rally nearly 30%.

- Capitec declares $274.89 million dividend, rewarding top shareholders including Mahloele and Le Roux.

- Mahloele’s wealth grows with Capitec’s stock surge, reinforcing his billionaire banking status.

South African businessman Tshepo Mahloele, founding CEO of Harith General Partners, has seen his indirect stake in Capitec Bank surge by nearly $367 million in just four months. The rebound follows a March retreat that pulled his holdings below the $1.5 billion mark.

Renewed investor interest and a bullish run in Capitec shares have since fueled the sharp recovery, boosting the bank’s market value and Mahloele’s wealth.

According to finance data chronicled by Shore.Africa, Mahloele’s Capitec Bank stake has climbed by R6.56 billion ($366.96 million) since April 4, 2025, pushing its market value above the $1.6 billion mark.

This increase mirrors the bullish momentum of Capitec’s share price on the Johannesburg Stock Exchange(JSE), driven by positive investor sentiment and expectations of continued growth.

This resurgence follows a prior downturn, during which his holdings decreased by R1.72 billion($94.63 million) between Feb. 7 and March 8, dropping from R27.12 billion($1.49 billion) to R25.4 billion($1.39 billion).

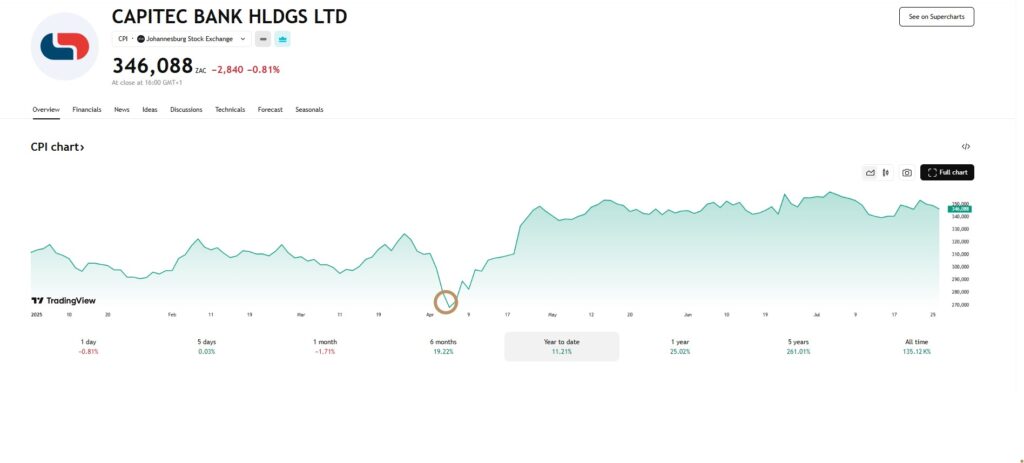

Capitec Bank’s shares soar by 29.1 percent

Capitec Bank, founded in 1999, and co-founded by Michiel Le Roux alongside Jannie Mouton and Riaan Stassen, has solidified its standing over the past two decades, amassing a substantial customer base.

With a network of more than 850 branches and 7,400 ATMs across South Africa, the bank has earned a reputation as one of the world’s top retail banking brands.

Over the past 115 days, Capitec Bank shares on the Johannesburg Stock Exchange have increased by 29.1 percent, climbing from R2,680.70 ($149.93) on April 4 to R3,460.86 ($193.56) at the time of writing, thus pushing its market cap above $22 billion and leading to substantial financial gains for shareholders, including Tshepo Mahloele who owns a significant stake in the group.

Mahloele’s stake in Capitec Bank rises above $1.6 billion

Mahloele, the founder and chairman of Lebashe Investment Holding Group, holds an indirect 7.26 percent stake in Capitec Bank, translating to 8,409,802 ordinary shares.

As a result of the bullish momentum, the market value of Mahloele’s stake has risen by R6.56 billion ($366.96 million) in about 115 days. His stake is currently valued at R29.11 billion ($1.63 billion), up from R22.54 billion ($1.26 billion) on April 4.

Shore Africa analysts suggest that if Capitec’s bullish momentum persists into the next quarter, pushing the stock above R4,000 ($223.72), Mahloele’s stake could be valued at up to $1.9 billion.

Capitec in fiscal year ended February 29, 2025, posted a net profit of R10.57 billion($579.97 million) in 2024, up from R9.15 billion($502.28 million). Total assets grew to R207.58 billion($11.39 billion) from R191.8 billion($10.53 billion), while retained earnings rose to R37.42 billion($2.05 billion) from R33.06 billion(1.81 billion).

Capitec Bank’s $274.9 million dividend windfall enriches top shareholders

Capitec Bank recently approved a final dividend of R44.25 ($2.38) per share, marking a 32.3 percent increase from the prior year.

In total, the bank distributed R5.14 billion ($274.89 million) to shareholders, significantly enriching four of its most prominent figures: billionaire co-founder Michiel le Roux, PSG Group chairman Jannie Mouton, former CEO Gerrie Fourie, and billionaire Tshepo Mahloele.

Michiel le Roux, Capitec’s co-founder and former CEO, emerged as the largest beneficiary. His 11.36 percent stake earned him R583.8 million ($31.21 million). Tshepo Mahloele, with a 7.26 percent stake, received R372.13 million ($20.81 million) in dividends.

Jannie Mouton, founder of investment firm PSG Group and a longtime Capitec backer, collected R261.86 million ($14 million) through the J.F. Mouton Familie Trust, which holds a 5.11 percent stake.

Capitec’s former CEO Gerrie Fourie bags $2.4 million farewell dividend

Gerrie Fourie, who retired this month as CEO after nearly two decades at the helm, received R45.47 million ($2.43 million) from his 0.89 percent shareholding—a parting reward from the bank he helped lead to prominence.

This strong dividend payout, coupled with Capitec’s bullish momentum, further cements Mahloele’s standing among South Africa’s elite billionaire bankers.

Beyond the Johannesburg Stock Exchange, his influence also stretches across the continent as one of the founders of the $630 million Pan African Infrastructure Development Fund (PAIDF).