At a Glance

- BUA Foods’ revenue soared 110% in 2024, led by flour and fortified sugar sales.

- Profits more than doubled to N266 billion ($173 million), rewarding investors with strong market returns.

- Shareholders approved higher dividends, boosting payouts to N234 billion at its latest AGM.

BUA Foods Plc, the food-processing giant, now accounts for nearly 12 percent of the Nigerian Exchange (NGX)’s total equity market value.

Founded in 1988, the company, founded by Nigeria’s second richest man, Abdul Samad Rabiu has grown from a rice and steel importer into the country’s most valuable listed firm.

Listed in January 2022, BUA Foods is currently valued at N10.6 trillion ($7.05 billion), ahead of other blue-chip names on the bourse.

Profits more than double as demand surges

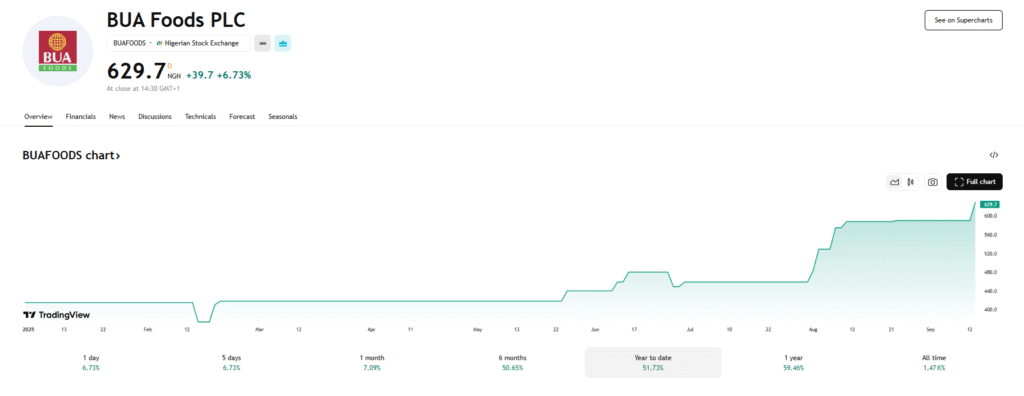

The company’s share price has rewarded investors handsomely, climbing nearly 52 percent this year from N415 ($0.28) to N629.7 ($0.42).

Earnings followed the same trend, with profit more than doubling to N266 billion ($173 million) from N112 billion ($74.4 million) in 2023.

Revenue jumped nearly 110 percent to N1.53 trillion ($1.02 billion), driven by bakery flour sales of N544.9 billion ($362.2 million) and a 67 percent increase in fortified sugar to N567.4 billion ($377.1 million). Other product lines, including pasta, semolina, and wheat bran, also supported growth.

Shareholders rewarded with higher dividend payouts

At its 4th AGM, BUA Foods, controlled by billionaire Abdul Samad Rabiu, approved a final dividend of N13 per share, up from N5.50 in 2023, amounting to N234 billion ($152.4 million).

Rabiu, who owns almost more than 92 percent of the company through BUA Group, pocketed N216.75 billion ($144.44 million), marking a 76 percent jump from the prior year.

The balance sheet strengthened with retained earnings rising 66 percent to N421 billion ($273.8 million), equity climbing to N429 billion ($279 million), and total assets edging up to N1.1 trillion ($712 million).