At a Glance

- Oil-rich nations dominate Africa’s reserves, driven by hydrocarbon exports and sovereign asset returns.

- Import-reliant states rely on tourism, agriculture and remittances to maintain essential reserve levels.

- Diversified economies like South Africa and Morocco build buffers through tourism and manufacturing exports.

Africa’s biggest forex reserves reveal how oil wealth, tourism, remittances and diversified exports shape the continent’s economic resilience. Foreign-exchange reserves remain one of the strongest indicators of a country’s ability to defend its currency, fund imports and withstand external shocks.

In Africa, reserves tell two stories at once: hydrocarbon windfalls and post-shock rebuilding. Libya and Algeria sit at the summit, their balances swollen by oil and gas receipts; South Africa and Morocco show how diversified exports, capital markets and tourism help accumulate buffers.

For net-importers such as Kenya and Tunisia, reserves reflect hard-won gains from tourism, agriculture and remittances, and the success (or strain) of stabilisation programmes.

Reserves levels are volatile, driven by commodity cycles, currency interventions and sovereign debt flows, so rankings shift as authorities buy, sell or revalue holdings.

In this 2025 ranking, Shore Africa profiles the 10 African countries with the largest foreign-reserve buffers, from oil-rich Libya and Algeria to diversified markets like South Africa and Morocco.

The list highlights how energy windfalls, policy reforms and sector diversification affect reserve accumulation across the continent.

1. Libya — $98.8 billion as of Sept. 2025

Oil export proceeds and sovereign asset management have driven Libya’s reserves. Political fissures complicate fiscal policy, but energy receipts remain the dominant reserve source.

2. South Africa — $71.55 billion

A diversified economy, mining, services, manufacturing, and active market access support reserves used to smooth rand volatility and service external obligations.

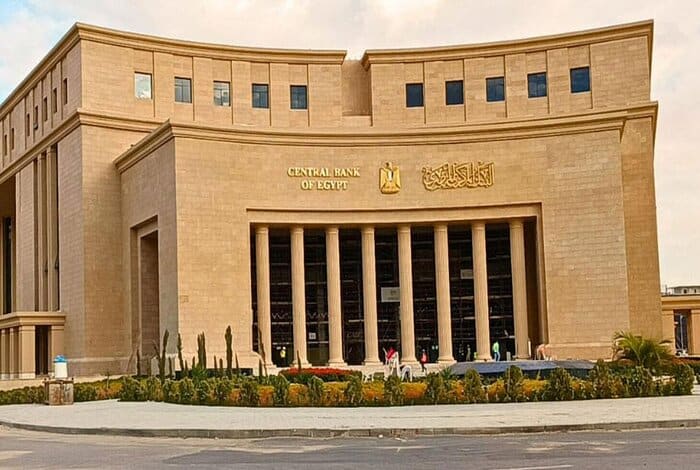

3. Egypt — $50.22 billion

Remittances, tourism recovery and diversified exports underpin Egypt’s reserves, which are central to policy as Cairo negotiates financing and reforms.

4. Algeria — $47.06 billion

Hydrocarbons underpin Algeria’s stockpile. Conservative fiscal policy and export receipts have sustained large reserves, though low oil prices pressure future accumulation.

5. Nigeria — $45.04 billion

Oil receipts, FX interventions and debt flows shape reserves. The central bank uses reserves to stabilise the naira and manage essential imports.

6. Morocco — $41.35 billion

Tourism, phosphates and manufacturing exports plus prudent central-bank policy helped Morocco expand reserves, improving import cover and creditworthiness.

7. Angola — $15.31 billion

Oil dominates Angola’s balance. Reserves provide a buffer against volatile prices but remain vulnerable to fiscal and external pressures.

8. Kenya — $12 billion

Agriculture, tourism and a vibrant services sector have helped Kenya build reserves to support the shilling and external commitments.

9. Mauritius — $9.48 billion

A small but diversified services-led economy; financial services, tourism and FDI underpin steady reserves and macro stability.

10. Tunisia — $8.5 billion

A mixed economy with tourism and manufacturing; reserves have been crucial for import cover amid political and fiscal adjustments.