At a Glance

- Foundations convert personal fortunes into institutional capital, reducing political, regulatory and succession risks.

- Billionaires retain influence through governance design while relinquishing ownership of foundation-held assets.

- Foundations stabilize business ecosystems by funding education, healthcare and infrastructure critical to long-term growth.

African billionaires are increasingly using foundations not just for philanthropy, but as a strategic tool to protect wealth, secure succession, and extend business influence.

When Africa’s richest man, Aliko Dangote, pledged a quarter of his fortune to his foundation, it was widely framed as generosity.

Within Africa’s billionaire class, however, the move reflected a deeper shift in how extreme wealth is being structured.

Across the continent, foundations are becoming institutional vehicles that stabilize capital, shield business empires from political and regulatory risk, and preserve control beyond the founder’s lifetime.

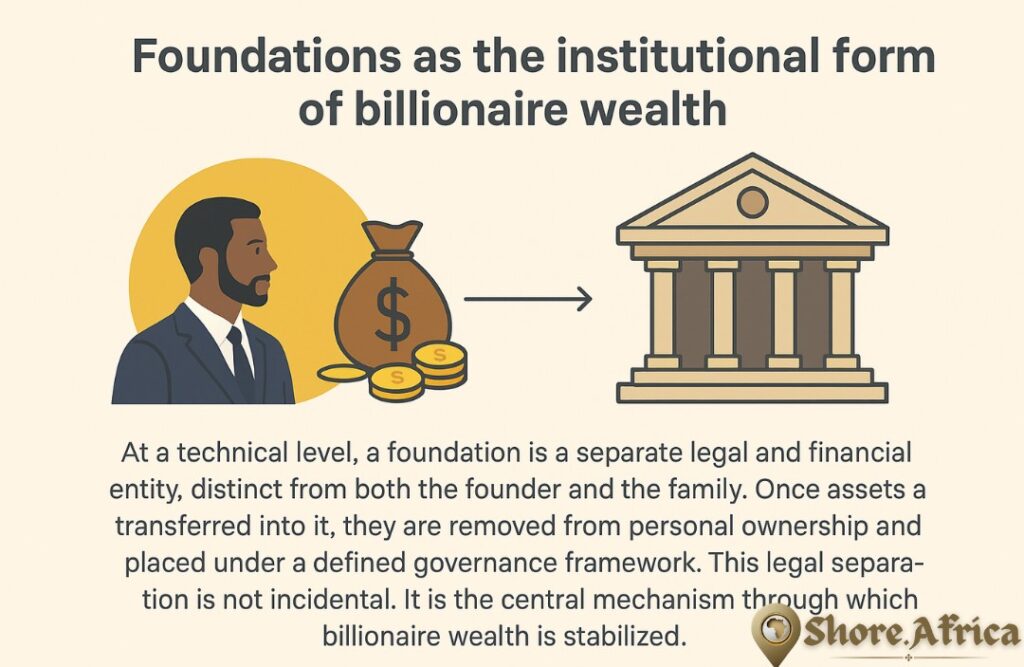

Foundations as the institutional form of billionaire wealth

For Africa’s wealthiest individuals, whose fortunes are often deeply tied to volatile markets, shifting political regimes and fragile regulatory systems, foundations convert personal capital into institutional capital. The money is no longer exposed to the risks that accompany individual ownership, yet it remains organised around the founder’s long-term vision.

Why African billionaires are increasingly choosing foundations

African billionaire wealth is unusually vulnerable. Political transitions, currency instability, weak inheritance enforcement and regulatory uncertainty combine to make long-term capital preservation difficult. Passing wealth directly to heirs often leads to fragmentation, forced asset sales and strategic drift.

Foundations address this vulnerability by locking capital into structures that cannot be casually dismantled. Assets placed inside them are no longer divisible along family lines and cannot be liquidated to fund private lifestyles. In effect, foundations transform wealth from something that can be consumed into something that must be managed.

Control without ownership in modern African capitalism

The most misunderstood aspect of billionaire foundations is the relationship between ownership and influence. While founders formally relinquish ownership of the assets transferred, they typically retain decisive influence through governance design. By setting mandates, appointing trustees and embedding family representation, founders ensure that decision-making remains aligned with their economic philosophy.

This arrangement allows African billionaires to avoid one of the most persistent threats to generational wealth, which is the loss of strategic coherence after succession. Foundations provide continuity where inheritance alone often produces disorder.

Foundations as strategic buffers for business empires

Although foundations are legally separate from operating companies, they often function as strategic extensions of business empires. Through investments in education, healthcare, agriculture and human capital, they help stabilise the ecosystems that sustain private enterprise.

In markets where governments struggle to provide public goods, billionaire foundations quietly absorb some of that responsibility. This is not altruism detached from business reality. It is a form of ecosystem defence that protects labour pools, supply chains and consumer bases over the long term.

The tax question and the limits of avoidance

In Africa, where estate and inheritance taxes remain limited or inconsistently enforced, foundations are rarely driven by tax avoidance in the narrow sense. Their primary value lies in predictability rather than exemption. They allow wealth to move into structures that are insulated from future policy shifts and jurisdictional uncertainty.

Any tax efficiency that arises is typically a secondary outcome of a broader strategy focused on capital durability rather than immediate savings.

Why inheritance is no longer trusted as a system

Across generations and geographies, inherited wealth has a poor survival record. Family structures alone often lack the governance discipline required to manage large and complex fortunes. Consumption pressures, internal disputes and the absence of institutional memory frequently lead to decline.

Foundations impose rules where families often cannot. They preserve capital logic, enforce long-term mandates and maintain strategic continuity. For Africa’s billionaire class, this institutional discipline has become more reliable than bloodlines alone.

The legitimacy dividend in unequal societies

In societies where inequality is highly visible and social trust is fragile, billionaire wealth increasingly requires justification. Foundations provide a public-facing framework that recasts private capital as a contributor to collective stability. This legitimacy is not symbolic. It reduces political pressure, strengthens community ties and lowers the risk of backlash against concentrated wealth.

For African billionaires operating in complex social environments, legitimacy has become an asset class of its own.

The evolution of African billionaire capitalism

When African billionaires pledge large portions of their wealth to foundations, they are not surrendering power. They are reorganising it into forms that are more durable, defensible and scalable. Foundations protect assets from fragmentation, stabilise business environments and extend influence beyond the lifespan of the founder.

This is not charity in its traditional sense. It is the institutional evolution of African capitalism.

Dangote and Gates: different contexts, same structural logic

Although Aliko Dangote and Bill Gates operate in vastly different economic and regulatory environments, their foundations perform similar structural functions. Both men have removed large portions of their wealth from personal ownership and placed them inside governed institutions designed to outlive them. The difference lies not in intent, but in context.

For Gates, the foundation manages succession, taxation exposure and global public scrutiny. For Dangote, it stabilises ecosystems, protects legacy and institutionalises capital within a continent marked by volatility. In both cases, the foundation is not an endpoint for wealth, but a reinforcement of its endurance.