At a Glance

- State-owned CBE dominates assets as private banks expand digitally and geographically nationwide.

- ESX launch signals Ethiopia’s shift toward capital markets and reduced deposit-only banking.

- Liberalisation and foreign bank entry threaten to reshape competition across Ethiopia’s financial sector.

Ethiopia’s banking sector is entering a pivotal transition as the country launches its first stock exchange in more than five decades and private lenders expand their reach.

Long dominated by locally owned banks and the state-controlled Commercial Bank of Ethiopia, the sector has remained largely closed to foreign competition.

The debut of the Ethiopian Securities Exchange (ESX) in January 2025 marks a structural shift, enabling banks to tap capital markets and broaden funding beyond deposits.

The exchange introduces equity and capital-market financing to a system historically reliant on deposits and state-directed lending, marking a foundational step toward financial liberalisation.

Private banks including Dashen Bank, Awash International Bank and Bank of Abyssinia have expanded aggressively through branch networks and digital services, scaling retail and SME lending nationwide.

With a population of about 126.5 million, according to the World Bank, Ethiopia is Africa’s second most populous country and one of the region’s fastest-growing economies.

As Ethiopia prepares for eventual foreign bank entry, competition is expected to intensify. While state dominance remains entrenched, private lenders are positioning themselves for a more open financial system shaped by capital markets, technology and regulatory reform.

Shore Africa has examined Ethiopia’s financial landscape. Below are profiles of the institutions shaping the country’s banking hierarchy.

1. Commercial Bank of Ethiopia (CBE)

Ethiopia’s largest bank and the dominant state-owned lender, CBE, controls nearly half of the country’s banking assets and deposits. It is the lynchpin of public financing, trade settlement and infrastructure lending, underpinning monetary flows across Ethiopia’s economy.

2. Dashen Bank

A major private commercial bank founded in 1995, Dashen is notable for its broad branch network and digital services, including mobile and online platforms. It continues to expand corporate and retail banking services across Ethiopia.

3. Awash International Bank

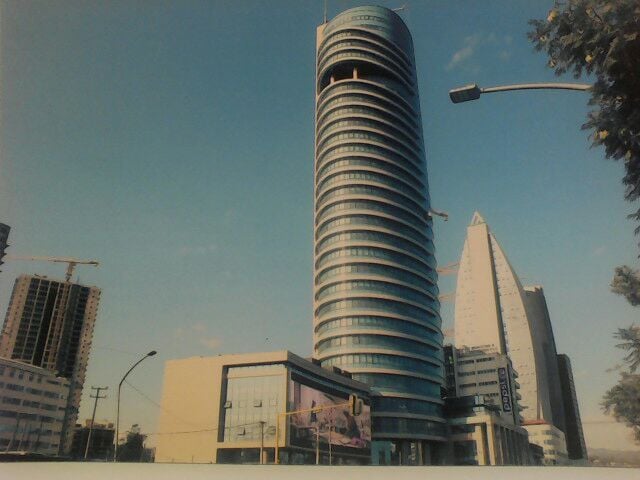

Awash International Bank (Awash Bank) is Ethiopia’s largest private commercial bank, founded in 1994 and headquartered in Addis Ababa, Awash combines extensive branch reach with diversified retail and corporate offerings. Its scale and revenue footprint place it among the top tier of non-state lenders.

4. Bank of Abyssinia

A key private lender with significant branch coverage, Bank of Abyssinia serves a broad customer base across retail, SMEs and corporate clients, contributing to sector growth outside the state monopoly.

5. Nib International Bank

Established in 2003, Nib offers comprehensive retail and business banking services. Its focused expansion and steady customer base position it as a mid-tier competitor in Ethiopia’s competitive private banking space.

6. Wegagen Bank

A long-standing private bank, Wegagen has carved out strength in corporate and trade finance. It also made strategic pivots into capital markets through ESX listing and investment banking licences.

7. Cooperative Bank of Oromia

Focused on community and agriculture-linked lending, CBO serves Oromia’s vast rural and SME segments, blending cooperative principles with commercial banking growth.

8. Gadaa Bank

Recently listed on Ethiopia’s securities exchange, Gadaa represents the frontier of Ethiopian lenders embracing capital markets and broader investor engagement.

9. Hibret Bank S.C., also known as United Bank

A legacy private bank with deep roots in Ethiopian commercial activity, United Bank balances traditional lending with evolving digital and trade services for SMEs and corporate clients.

10. Development Bank of Ethiopia

State-owned development finance institution focusing on long-term project finance outside traditional commercial banking; critical for infrastructure and public investment.