At a Glance

- Governments and private capital deploy billions into stadiums, media rights and sports technology assets.

- Long-term funding models replace one-off tournament spending across Africa’s major sports markets.

- Global financiers and African billionaires reshape ownership, monetization and governance of sports infrastructure.

Africa’s sports industry is entering a new investment phase in 2025 as governments, development banks, billionaires and private equity firms commit record capital to stadiums, broadcast rights and commercial leagues.

What was once driven largely by passion and public spending is now shaped by long-term funding, structured partnerships and revenue models tied to media rights, sponsorships and digital platforms.

With Africa’s population skewing young and increasingly urban, sports has become a strategic economic asset.

Large-scale investments now support tourism, urban renewal, job creation and foreign exchange inflows, while positioning cities and countries for global visibility beyond single tournaments.

From Morocco’s World Cup-linked infrastructure push to pan-African financing backed by Afreximbank and IFC-supported platforms, capital is flowing into assets designed to generate returns long after major competitions end.

Global institutions are increasingly investing alongside Africa’s wealthiest individuals, reshaping how sports is financed, owned and monetized across the continent.

Shore Africa profiles 15 of the biggest sports investments shaping Africa in 2025, ranked by scale and strategic impact.

1. Morocco World Cup & AFCON Infrastructure

Location: Morocco

Value: $15 billion

A sweeping upgrade of stadiums, transport and hospitality assets ahead of AFCON 2025 and the 2030 World Cup, positioning Morocco as Africa’s sports infrastructure hub.

2. South Africa Stadium Revitalization Fund

Location: South Africa

Value: $2 billion

South Africa revamped 10 stadiums that hosted 64 matches of the FIFA World Cup in 2010, making it the first African nation to host the prestigious tournament, held from June 11 to July 11, 2010.

3. Egypt National Stadium Redevelopment

Location: Egypt

Value: $550 million

State-backed modernization of Cairo’s flagship stadium, integrating hospitality, retail and media infrastructure.

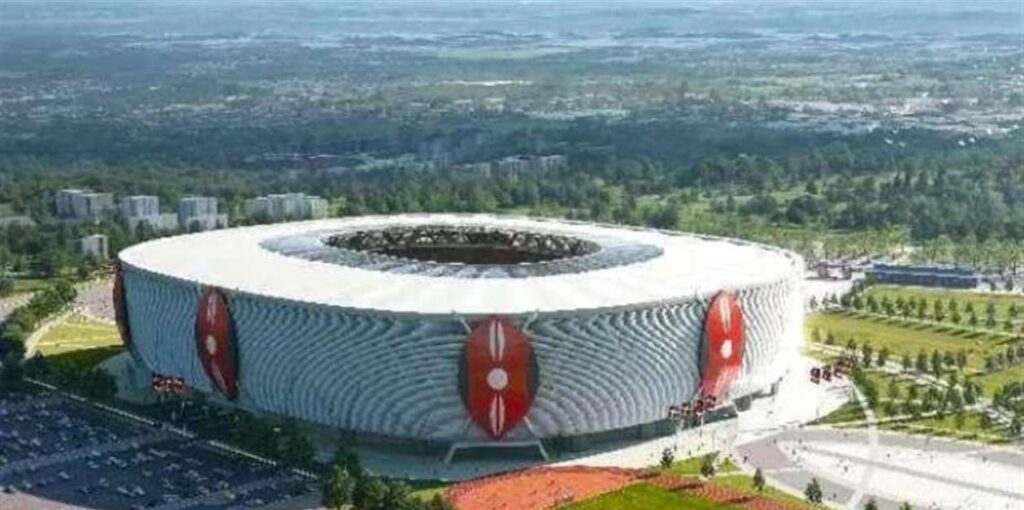

4. Senegal Diamniadio Sports Complex

Location: Senegal

Value: $250 million

A multipurpose sports city supporting football, athletics and regional competitions near Dakar.

5. Rwanda Sports Infrastructure Program

Location: Rwanda

Value: $200 million

Government-led investments tied to sports tourism, conference hosting and elite athlete development.

6. Talanta Sports City

Location: Kenya

Value: $135 million

A multi-sport complex anchored by a new national stadium, central to Kenya’s ambition to host continental and global athletics events.

7. Uganda Hoima City Stadium

Location: Uganda

Value: $130 million

A flagship stadium aligned with East Africa’s joint AFCON hosting ambitions.

8. Algeria Olympic Sports Program

Location: Algeria

Value: $120 million

State-backed funding for elite training facilities ahead of global competitions.

9. Lagos Arena Project

Location: Nigeria

Value: $100 million

A private-sector-led indoor arena designed for basketball, concerts and global sporting events, strengthening Lagos’ position as West Africa’s sports-entertainment capital.

10. CAF Broadcast & Digital Expansion

Location: Pan-African

Value: $100 million

Investment into streaming, broadcast infrastructure and data platforms to grow continental viewership revenues.

11. Ghana National Sports Authority Upgrades

Location: Ghana

Value: $80 million

Targeted refurbishments of key stadiums to meet CAF and FIFA standards.

12. Tunisia Sports Tourism Investment

Location: Tunisia

Value: $60 million

Private capital targeting coastal sports resorts, training camps and international tournaments.

13. Helios Sports & Entertainment Group

Location: Pan-African

Value: $50 million

Helios-backed platform investing in sports IP, event production and infrastructure, targeting scalable, commercially viable African sports properties. It secured a $50 million equity commitment from the International Finance Corporation (IFC) and Proparco

14. Afreximbank–CAF Sports Economy Program

Location: Pan-African

Value: $50 million

Afreximbank-backed financing for stadium upgrades, competitions and sports enterprises, aimed at professionalizing Africa’s football value chain.

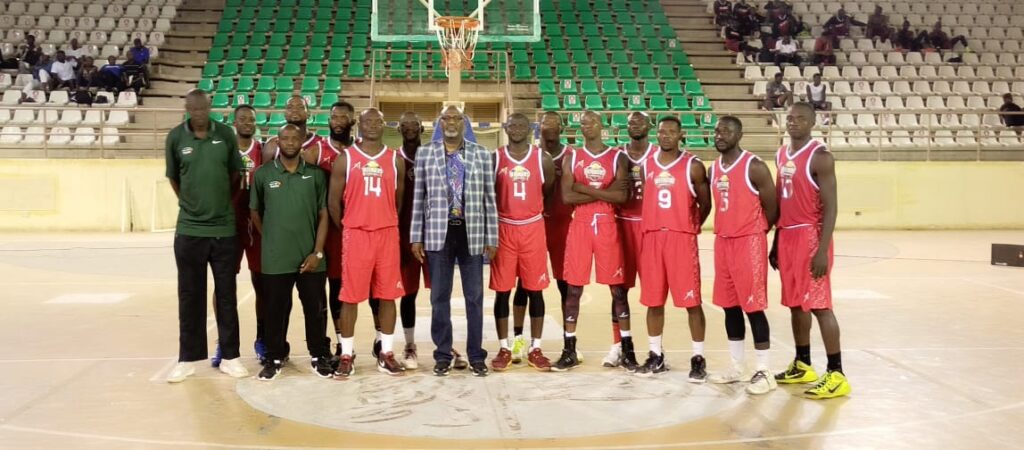

15. Nigeria Basketball League Commercialization

Location: Nigeria

Value: $30 million

Private investors backing league operations, media rights and youth development pipelines.