At a Glance

- AfroCentric exits capital-heavy pharma to focus on health administration and managed care earnings.

- Deal delivers R350 million upfront cash plus earnout tied to Activo performance.

- Proceeds earmarked for debt reduction and reinvestment in core healthcare services.

AfroCentric Investment Corporation, a Johannesburg-listed investment holding company majority owned by Sanlam, plans to sell Activo Health, its pharmaceutical manufacturing and marketing unit, to Portugal-based FHC Group as it repositions its balance sheet and narrows its strategic focus on managed healthcare services.

The transaction, announced Dec. 23, marks a clear shift away from capital-intensive pharmaceutical operations toward health administration and managed care, which generate the bulk of AfroCentric’s recurring earnings. The disposal assets carry a total value of about R1.1 billion ($66 million).

Transaction structure and assets

Under the sale and purchase agreement, AfroCentric subsidiary ACT Healthcare Assets will sell its entire interest in Activo Health, including indirect holdings in Activo Healthcare Assets and Forrester Pharma. The buyer, FHC Proprietary Limited, is backed by a parent guarantee from privately held FHC Group, which operates across 65 countries.

Activo Health, a pharmaceutical manufacturer that imports, markets and distributes pharmaceutical products, trading across all pharmaceutical sectors, functions as both a pharmaceutical trading business and a holding company, controlling a portfolio of registered generic medicines across chronic therapies, antiretrovirals, hospital products, over-the-counter medicines and medical devices.

As of June 30, 2025, Activo reported consolidated net assets of R299 million ($18 million) and profit of R9 million ($540,123) for the six-month period. When goodwill, other intangible assets of R492 million ($29.53 million) and shareholder claims of R300 million ($18 million) are included, the carrying value of the disposal assets rises to roughly R1.1 billion ($66 million).

Consideration and earnout

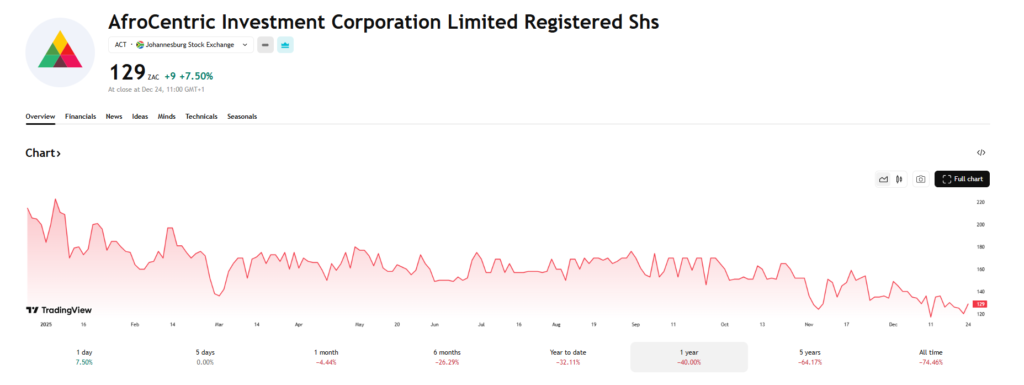

AfroCentric, with a market capitalization of R1.09 billion ($65.4 million), will receive an upfront cash payment of R350 million ($21 million) on a cash-free, debt-free basis at closing.

Additional consideration includes a deferred payment subject to net debt and working capital adjustments, as well as an earnout of up to R250 million ($15 million) tied to Activo’s financial performance.

The earnout will be paid over three years, beginning from the third anniversary of the transaction’s completion.

Strategic rationale and balance sheet impact

Management said the disposal is aimed primarily at deleveraging the group. Most proceeds are expected to be applied toward reducing debt, lowering interest costs and improving financial flexibility.

Remaining capital will be redeployed into core growth areas such as health administration, managed care and corporate healthcare solutions—segments that offer operational synergies and higher returns on capital.

Regulatory approvals

For FHC Group, the acquisition provides a platform to expand its footprint in Africa using established product registrations and manufacturing capabilities. For AfroCentric shareholders, the transaction crystallizes value from a non-core asset while simplifying the group’s operating model.

Because the deal exceeds the JSE’s 30 percent materiality threshold, it is classified as a Category 1 transaction. It remains subject to shareholder approval and regulatory clearances, with a long-stop date of June 30, 2026.