At a Glance

- Family-controlled conglomerates anchor Africa’s largest fortunes across industry, finance, energy, and telecoms.

- Business groups act as control centers for capital allocation, governance, succession, and long-term wealth preservation.

- From Nigeria to Egypt, these families shape markets, policy influence, and national economic structures.

Africa’s billionaire fortunes are rarely built by individuals alone. Across the continent, wealth is concentrated within family-controlled business groups spanning cement, banking, telecoms, energy, mining, real estate, and private equity.

From Aliko Dangote’s Dangote Group in Nigeria to Egypt’s Sawiris and Mansour families, these tightly held conglomerates act as control centers for capital, governance, and succession. Together, they anchor national economies, shape employment, and influence policy across Africa.

Across cement plants, telecom networks, luxury brands, banks, mines, and private equity vehicles, these families control the business groups that quietly anchor national economies and influence policy, employment, and capital flows.

What sets Africa’s richest families apart is longevity. Many began as traders, industrialists, or financiers in post-independence economies and scaled into continental or global players.

Over time, their structures evolved into tightly held conglomerates, often family-controlled, designed to preserve wealth, manage risk, and enable generational succession.

Their holding companies act as control centers, deploying capital across sectors, grooming heirs, and increasingly professionalizing governance.

Below is a curated snapshot of 21 African billionaire families and the business groups at the core of their empires, researched and profiled by Shore Africa

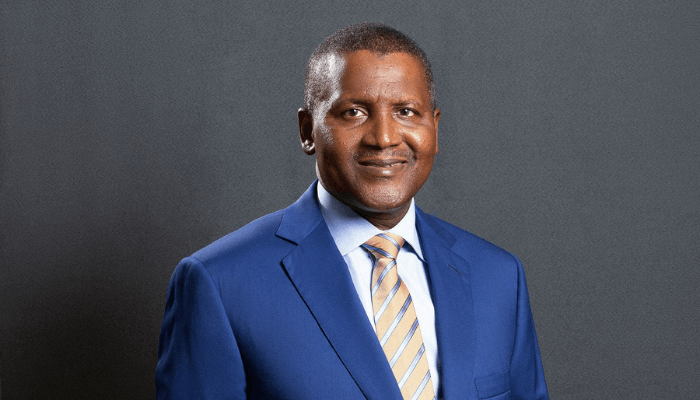

1. Aliko Dangote Family

Controlling Group: Dangote Group

At the helm stands Aliko Dangote, Africa’s wealthiest individual, who has a net worth of $26.1 billion as of writing. The Dangote Group, his conglomerate, has interests in cement, sugar, and flour production. The recent valuation surge is largely attributed to the Dangote Refinery, poised to revolutionize Nigeria’s oil industry. His daughter, Halima Aliko Dangote, serves as a Group Executive Director at Dangote Industries Limited. She has held roles including Executive Director of Dangote Flour Mills and NASCON, demonstrating the family’s ongoing leadership within the conglomerate. The Dangote family’s legacy of entrepreneurship extends back to Aliko’s great-grandfather, Alhassan Dantata, once West Africa’s richest person. This tradition continues as family members actively contribute to the group’s success, ensuring its enduring impact on Africa’s economic landscape.

2. The Sawiris Family

Controlling Group: Orascom Group

The Sawiris family from Egypt, boasting a total net worth surpassing $15 billion, represents a cornerstone of entrepreneurship in the Middle East. The late patriarch, Onsi Sawiris, established the groundwork by founding the Orascom conglomerate, which has varied interests in construction, telecommunications, and tourism. His heritage is continued by his sons: Nassef, Naguib, and Samih. Nassef Sawiris, the richest of the group with an estimated net worth of $8.3 billion, manages Orascom Construction Industries and possesses major shares in organizations such as Madison Square Garden Sports and Adidas. Naguib Sawiris, possessing a fortune of $5 billion, has left a significant impact on the telecommunications industry, particularly via Orascom Telecom Holding. Samih Sawiris, with a net worth of $850 million, while not as widely recognized, has added to the family’s portfolio with investments in tourism and real estate development. Together, the Sawiris family’s strategic investments and business endeavors have greatly impacted Egypt’s economic environment.

3. The Rupert Family

Controlling Group: Richemont

Johann Rupert and his family possess a net worth of $15.2 billion, making them the richest in South Africa. Johann leads Compagnie Financière Richemont, managing luxury brands such as Cartier and Montblanc. His son, Anton Rupert Jr., is being groomed to take over the family’s assets, which include Richemont, Remgro, and Reinet. In November 2024, Johann brought the entire family into the holding company that governs Richemont, establishing a cohesive succession strategy. Johann Rupert is also recognized for his conservation initiatives, especially in South Africa’s Karoo region, where he holds land and has opposed fracking projects.

4. The Nicky Oppenheimer Family

Controlling Group: Oppenheimer Generation

Nicky Oppenheimer and his family hold a net worth of $10.6 billion, solidifying their status among Africa’s richest. Oppenheimer Generations serves as the central group for the investments and philanthropic activities of Nicky and Jonathan Oppenheimer. Through this entity, he manages various investments, including Fireblade Aviation, which operates chartered flights, and his extensive conservation landholdings. Nicky, the heir to the De Beers diamond legacy, sold the family’s 40 percent ownership in De Beers to Anglo American in 2012 for $5.1 billion in cash. Beyond the diamond industry, the Oppenheimer family has diversified their investments through initiatives like Oppenheimer Partners, which was established by Nicky’s son, Jonathan, in 2016. In 2014, they founded Fireblade Aviation and own extensive conservation land across Southern Africa.

5. The Rabiu Family

Controlling Group: BUA Group

Abdulsamad Rabiu, the founder and chairman of BUA Group, boasts a net worth of $9.8 billion, placing him among the richest people in Africa. BUA Group, launched in 1988, has greatly impacted Nigeria’s industrial sector through its activities in cement manufacturing, sugar processing, and real estate. Abdulsamad comes from a distinguished family; his father, Khalifah Isyaku Rabiu, was a significant industrialist and Islamic scholar in Nigeria. Abdulsamad has 42 siblings, among them Nafiu Rabiu, who ran the family business in the 1980s, and Rabiu Rabiu, the chairman of IRS Airlines.

6. The Mike Adenuga Family

Controlling Group: Mike Adenuga Group

Mike Adenuga’s business empire is primarily housed under the umbrella of the Mike Adenuga Group. This conglomerate serves as the holding structure for his various ventures, which are heavily concentrated in telecommunications, oil and gas, and real estate. Mike Adenuga and his family have an estimated net worth of $6.4 billion, solidifying their position among Nigeria’s wealthiest. Adenuga’s business empire includes Globacom, Nigeria’s second-largest telecommunications operator, and Conoil, a prominent player in the oil exploration industry. His daughter, Bella Disu, serves as the Executive Vice Chairman of Globacom and holds a non-executive director position at Julius Berger Nigeria Plc. The Adenuga family’s influence spans telecommunications, oil, and various other sectors, significantly impacting Nigeria’s economic landscape.

7. The Mansour family

Controlling Group: Mansour Group

The Mansour family from Egypt, under the leadership of Mohamed Mansour, has established a powerful business empire via their conglomerate, the Mansour Group. Mohamed Mansour has a net worth of $3.4 billion and manages various operations for the group, such as automotive distribution, consumer goods, and real estate. His brothers, Youssef and Yasseen Mansour, are also crucial to the organization. Youssef Mansour, whose net worth is $1.4 billion, is the chairman of Mansour Group. Yasseen Mansour, valued at $1.2 billion, presides over Palm Hills Developments, a prominent real estate firm within the group’s portfolio. The Mansour Group boasts significant partnerships, including being one of the largest General Motors dealers worldwide and possessing important distribution rights for brands such as Caterpillar and McDonald’s in Egypt. The family’s strategic foresight and varied ventures have reinforced their role as influential figures in Egypt’s economic landscape.

8. The Patrice Motsepe and family

Controlling Group: Ubuntu-Botho Investments (UBI) group

Patrice Motsepe’s business interests are primarily housed under the Ubuntu-Botho Investments (UBI) group, which acts as the overarching investment holding company. African Rainbow Capital (ARC): A subsidiary of UBI, founded in 2015, which focuses on financial services, telecommunications (including a stake in Rain), and diversified investments. African Rainbow Minerals (ARM): A JSE-listed mining company founded by Motsepe in 1997, focusing on gold, platinum, coal, and iron ore. Now, the billionaire, who is also CAF president, has no much ado as his business empire is firmly in shape under this umbrella. Patrice Motsepe, founder and chairman of African Rainbow Minerals (ARM) has a net worth of $4.2 billion. He made history by becoming the first African billionaire on the Forbes list. Also, he is the chairman of the Confederation of African Football (CAF) and owns the South African club Mamelodi Sundowns, leading them to success in 2016.

9. The Issad Rebrab Family

Controlling Group: Cevital Industrial Group

All of Issad Rebrab’s business ventures are housed within the Cevital Group. Founded in 1971 by Issad Rebrab, Cevital is the largest private company in Algeria. Issad Rebrab and his family have an estimated net worth of $3 billion, positioning them among Algeria’s wealthiest. Rebrab founded Cevital is Algeria’s largest privately-owned conglomerate. The business is diversified in food processing, retail, and industry. In July 2022, after more than 50 years at the helm, he appointed his son, Malik Rebrab, as CEO, marking a significant leadership transition. Under Malik’s leadership, Cevital has pursued expansion into West Africa, notably reviving ambitions to establish a presence in Côte d’Ivoire. The Rebrab family’s strategic vision continues to influence Algeria’s economic landscape, with Cevital owning one of the world’s largest sugar refineries and holding stakes in European companies such as Groupe Brandt and Alas Iberia.

10. The Koos Bekker Family

Controlling Group: Naspers/Prosus Group

Koos Bekker’s business interests, particularly his massive investments in technology, e-commerce, and media, are primarily housed within the Naspers group and its Amsterdam-listed subsidiary, Prosus. Koos Bekker, Karen Roos (wife) and their two children boasting a net worth of $3.8 billion, changed South Africa’s media sector by turning Naspers into an international tech and media giant. His tactical choice to invest in Tencent in 2001 transformed a modest publishing firm into a multibillion-dollar empire. In addition to Naspers, Bekker’s impact reaches Prosus, a significant global consumer internet organization. His wife, Karen Roos, a former editor of Elle Decoration, has also been instrumental in the family’s fortune, possessing the opulent Babylonstoren estate, a celebrated vineyard and hotel in the Cape Winelands. The Bekker Family ventures in media, e-commerce, and hospitality are consistently impacting sectors in Africa and beyond, solidifying their status as one of the wealthiest and most powerful families on the continent.

11. The Dewji Family

Controlling Group: MeTL Group

All of Mohammed Dewji’s businesses are housed in the MeTL Group (Mohammed Enterprises Tanzania Limited). MeTL Group is a prominent Tanzanian-based family-owned conglomerate with a diverse portfolio of over 30 industries, spanning 11 countries across Africa. Mohammed Dewji, the son of late Gulamabbas Dewji, possesses an estimated net worth of $2.2 billion, making him the only billionaire in East Africa and ranking him 12th among Africa’s wealthiest. He heads MeTL Group, a conglomerate established by his father, Gulamabbas Dewji, during the 1970s. Under Mohammed’s guidance, MeTL has broadened its reach to 11 countries, accounting for around 4 percent of Tanzania’s GDP and employing over 34,800 individuals. The Dewji family’s presence in the business is substantial: Gulamabbas acts as chairman; Mohammed’s brother, Hussein Dewji, serves as sales director; another brother, Hassan Dewji, manages human resources; and his sister, Fatema Dewji, occupies the role of marketing director. Altogether, the Dewji family has profoundly shaped Tanzania’s economic environment through their varied business initiatives.

12. Anas Sefrioui Family

Controlling Group: Douja Promotion Groupe Addoha

Anas Sefrioui’s business interests are primarily housed in Douja Promotion Groupe Addoha (often referred to simply as Addoha Group or Groupe Addoha. Anas Sefrioui, a notable Moroccan property tycoon, boasts a net worth of $1.4 billion making him the richest person in Morocco. He established Groupe Addoha in 1988, concentrating on affordable housing projects. His son, Malik Sefrioui, holds the position of vice president at Ciments de l’Atlas, a subsidiary of Groupe Addoha, and has recently purchased a $15.4 million waterfront estate in Miami Beach. Anas’s daughter, Kenza Sefrioui, serves as the vice president of Groupe Addoha, and his nephew, Saad Sefrioui, is influential in the company’s management. The strategic leadership of the Sefrioui family continues to have a major impact on Morocco’s real estate industry.

13. The Benjelloun Family

Controlling Group: O Capital Group

All of Othman Benjelloun’s business interests are primarily housed within the O Capital Group. Formed in July 2021 through the merger of FinanceCom and Holding Benjelloun Mezian, this Casablanca-based holding company serves as the central pillar for his family’s empire. Othman Benjelloun and his family have a net worth of $1.9 billion, underscoring their significant role in Morocco’s financial sector. Othman Benjelloun, chairman of O Capital Group, is the driving force behind Morocco’s financial expansion. He oversees the Bank of Africa, which operates in over 20 countries. His vision stems from five generations of entrepreneurial excellence dating back to the 19th century. His late wife, Leïla Mezian Benjelloun, co-founded the Benjelloun-Meziane Foundation, supporting education and cultural preservation. Their son, Kamal, an advocate for sustainability, invests in renewable energy across Africa and the Americas. Daughter Dounia, a filmmaker, leads award-winning productions. The Benjelloun family’s influence extends across banking, insurance, and philanthropy, shaping Morocco’s financial and cultural landscape while maintaining a commitment to long-term, strategic investments.

14. The Otedola Family

Controlling Group: Calvados Global Services

Calvados Global Services Limited is the primary investment vehicle through which Nigerian billionaire Femi Otedola holds and executes major equity positions. While Otedola does not operate a single umbrella company housing all his assets, Calvados plays a central role in managing his public-market investments, most notably his strategic stakes in FBN Holdings Plc, the parent of First Bank of Nigeria. The vehicle reflects Otedola’s broader investment philosophy—active portfolio management anchored on diversification across energy, finance, and real estate. His wealth, estimated at $1.7 billion, was initially built through commodities trading before he pivoted decisively into energy. That shift accelerated after he exited Forte Oil, freeing capital for large-scale power investments. In late 2025, Otedola reshaped his energy portfolio by selling a 77 percent controlling stake in Geregu Power Plc in a transaction valued at $750 million. The deal was executed through the sale of his 95 percent stake in Amperion Power Distribution Company Limited to MA’AM Energy Limited, effectively transferring control of the power generation company. Otedola is the son of the late Sir Michael Otedola, a former governor of Lagos State. His wife, Nana Otedola, and their four children have largely pursued independent paths, maintaining a low public profile relative to the family patriarch.

15. The Jannie Mouton Family

Controlling Group: PSG Group

Johannes “Jannie” Mouton’s business interests are primarily housed in PSG Group. Jannie Mouton founded the PSG Group in November 1995 alongside Chris Otto after being fired from his previous job. It operates as an investment holding company that has built various successful businesses in financial services, banking (notably Capitec), education (Curro, Stadio), and agriculture Johannes Mouton, the founder of PSG Group with a net worth of $2.5 billion. Jannie Mouton, after being ousted from his own company at the age of 48, Mouton founded PSG Group in 1995, evolving it into a diverse investment holding firm with interests in banking, education, finance, and consumer products. His son, Piet Mouton, now acts as PSG’s CEO, while his eldest son, Jan, oversees the PSG Flexible Fund and serves as a non-executive director for the company. The Mouton family collectively retains a 24.5 percent ownership in PSG, highlighting their considerable impact on the company’s strategic operations. In 2018, Jannie Mouton revealed his early-stage dementia diagnosis, prompting him to resign as PSG’s chairman.

16. The Christoffel Wiese Family

Controlling Group: Titan Global Investments

Christoffel Wiese’s business empire is primarily housed under his private investment holding company, Titan (or Titan Global Investments). Through Titan, Wiese manages his significant, controlling, or large shareholdings in several major companies. Retail tycoon Christoffel Hendrik Wiese, boasting an estimated net worth of $2 billion, amassed his wealth via Pepkor Holdings and previous ownership of Shoprite, the largest supermarket chain in Africa. Despite financial challenges stemming from the Steinhoff scandal, Wiese remains a powerful player in both retail and investments. His son, Jacob Wiese, is instrumental in overseeing the family’s various investments, which encompass real estate and private equity. Her daughter, Clare Wiese, has also garnered attention for her real estate investments, including the purchase of a $7 million mansion in Cape Town. The family’s impact reaches into high-end products via Lourensford Wine Estate, a top vineyard in South Africa. Wiese’s tactical insight and perseverance have maintained his family among South Africa’s richest, influencing the retail and consumer environment throughout the continent.

17. The Akhannouch Family

Controlling Group: Akwa Group

Aziz Akhannouch’s business empire is primarily housed in the Akwa Group (or AKWA Group), a multibillion-dollar Moroccan conglomerate. Founded by his father, Ahmed Ouldhadj Akhannouch, and partner Ahmed Wakrim in 1932. The Akhannouch family in Morocco, comprising Aziz, Salwa and their three children, has established a powerful business empire, led by Aziz Akhannouch, who serves as the nation’s Prime Minister. With a net worth of $1.6 billion, he oversees Akwa Group, a multibillion-dollar conglomerate leading Morocco’s petroleum, gas, and chemicals industries. His wife, Salwa Idrissi Akhannouch, is a formidable force in retail and real estate, leading Aksal Group, which holds exclusive franchises for labels such as Zara and manages the renowned Morocco Mall. She ranked 23rd in the Forbes 2025 100 Most Powerful Businesswomen. Despite their political duties, the Akhannouch family continues to be among Morocco’s richest, influencing both commerce and government while holding significant control over the nation’s energy and retail sectors.

18. The Masiyiwa Family

Controlling Group: Econet Group

Strive Masiyiwa’s businesses are primarily housed under the Econet Group (often referred to as Econet Global or Econet Wireless Group). Strive Masiyiwa, the founder and executive chairman of Econet Global and Cassava Technologies, has an estimated net worth of $1.5 billion, placing him among Africa’s richest individuals. His wife, Tsitsi Masiyiwa, co-established the Higherlife Foundation, which has awarded scholarships to more than 250,000 young Africans since 1996. Their daughter, Tanya Masiyiwa, is highly engaged in philanthropic efforts, attributing her motivation to her mother’s influence. The Masiyiwa family’s charitable work has greatly influenced education and healthcare throughout the continent, demonstrating their dedication to Africa’s socio-economic progress.

19. The Mo Ibrahim Family

Controlling Group: Satya Capital Limited

Mo Ibrahim’s investments and business interests are primarily managed through Satya Capital Limited, a private equity fund focused on Africa. Sudanese-born billionaire Mo Ibrahim, with a net worth of $1.3 billion, made his fortune in telecommunications after founding Celtel International, which provided mobile services across Africa before its $3.4 billion sale in 2005. His daughter, Hadeel Ibrahim, plays a key role in the Mo Ibrahim Foundation, which promotes good governance in Africa. The family’s influence extends into philanthropy, with Ibrahim’s foundation awarding the Ibrahim Prize for Achievement in African Leadership. Despite stepping away from business, the Mo Ibrahim family remains a dominant force in Africa’s development, focusing on governance, transparency, and economic empowerment across the continent.

20. The Kenyatta Family

Controlling Group: Enke Investments Limited

The main investment vehicle for the Kenyatta family business empire is Enke Investments Limited. This firm is identified as sitting “at the top of the food chain” in the Kenyatta family business empire, owned by former First Lady Mama Ngina Kenyatta, her son Muhoho Kenyatta, and Goodison Trust Corporation. The Kenyatta family, a powerful entity in Kenya’s socio-economic and political realms, has shaped the nation since independence. Key members include matriarch Ngina Kenyatta, her sons Muhoho and former President Uhuru Kenyatta, who have bolstered their influence in finance, agriculture, media, and real estate. The family’s origins trace back to Jomo Kenyatta, Kenya’s first president. The family owns over 500,000 acres of prime agricultural land – the largest landowner in Kenya and holds a 13.2 percent stake in NCBA Group. Their investments include Enke Investments Ltd. and Mediamax Network Limited for media control. Their ventures extend to hospitality with Heritage Group, Northlands City’s ambitious development, and significant contributions in education and agriculture, reinforcing their economic dominance in Kenya.

21. Sudhir Ruparelia and family

Controlling Group: Ruparelia Group

Sudhir Ruparelia, Uganda’s richest man, built a diversified empire through Ruparelia Group, spanning real estate, education, banking, and hospitality. After returning to Uganda in 1985 with $25,000 saved from odd jobs in the UK, following Idi Amin’s expulsion of Asians in 1972, he launched a beer import business and foreign exchange bureau, later founding Crane Bank, once among Uganda’s top lenders. Though Crane Bank was controversially taken over in 2016, Uganda’s Supreme Court ordered its return in 2022. Dubbed the “Landlord of Kampala,” Ruparelia owns more than 200 commercial properties and premium hotels under Speke Group, including the decisive acquisition of the 14-storey Lotis Towers (now Arie Towers), which was finalized in 2024. Once valued at $800 million in 2015, his fortune has shrunk to around $250 million, reflecting both market volatility and mounting liabilities across his business portfolio across sub-Saharan Africa.