Africa’s financial system is being transformed in real time by a new generation of financiers, not just policy or foreign capital.

From Casablanca to Cape Town, Lagos to Nairobi, these leaders are reshaping banking, insurance, and fintech, expanding credit, mobilizing savings, and driving financial inclusion across the continent. Pan-African banks fund infrastructure, insurers leverage data to grow, and fintech startups deliver digital access to millions once excluded.

This generation is distinguished less by personal wealth than by institutional consequence. Banking leaders are constructing pan-African platforms with balance sheets deep enough to fund trade, infrastructure, and enterprise at scale.

Insurance executives are recasting underwriting through data, behavior, and technology, turning protection into a growth engine rather than a cost.

Fintech founders are bypassing legacy rails entirely, extending payments, credit, and investment access to millions once locked out of formal finance.

The operating environment remains unforgiving, with volatile currencies, fragmented regulation, and shallow capital markets. Yet Africa’s financiers have adapted with precision.

They structure deals in local currency, partner with development lenders, and deploy technology to compress risk and expand inclusion.

Together, the financiers profiled here steward billions in assets, influence policy, and shape regional financial architecture. Shore Africa presents a profile-by-profile look at 25 business financiers whose decisions continue to define the present and future of African finance.

1. Naguib Sawiris

Nationality: Egyptian

Bank founded: RiverBank SA

Net Worth: $5.1 billion

Egyptian tycoon Naguib Sawiris, renowned for his leadership of Orascom Investment Holding, founded RiverBank SA to transform Africa’s financial landscape. Leveraging decades of experience across telecoms, media, and industry, he has guided RiverBank’s expansion in retail and corporate banking. Sawiris also holds a notable stake in the National Bank of Egypt (NBE), reinforcing his influence in the country’s financial sector. His strategic vision and investment acumen continue to shape RiverBank and broader banking developments in the region, cementing his reputation as one of Africa’s most influential financiers.

2. Patrice Motsepe

Nationality: South African

Bank founded: Tyme Bank

Net Worth: $4.2 billion

South African billionaire Patrice Motsepe, founder of African Rainbow Minerals (ARM), has solidified his standing as Southern Africa’s most successful Black entrepreneur. His influence stretches far beyond mining, with strategic investments reshaping Africa’s financial sector through African Rainbow Capital (ARC), the Black-owned investment powerhouse under his Ubuntu-Botho Investments. One of his flagship ventures, TymeBank, has emerged as one of Africa’s fastest-growing digital banks, serving over 6.2 million customers across South Africa and the Philippines.

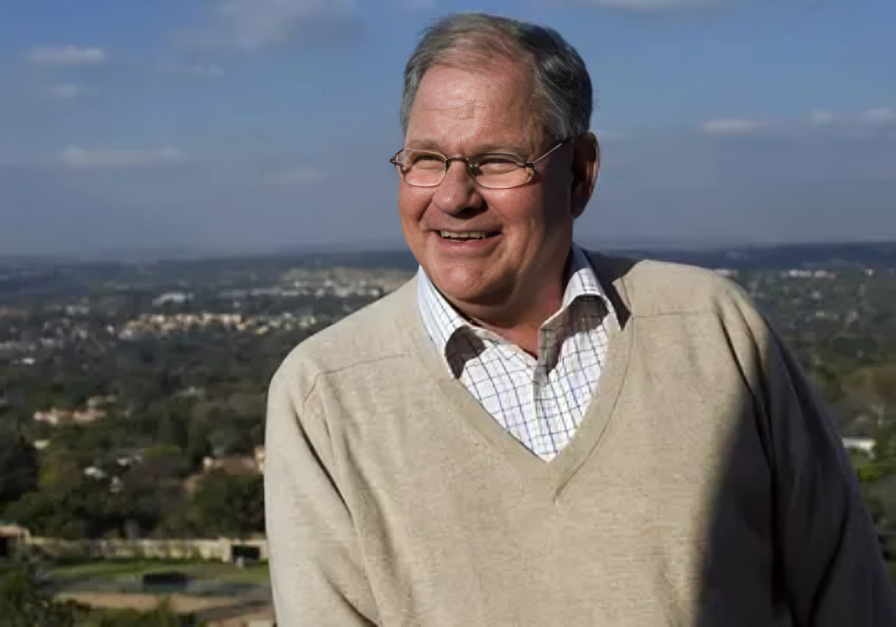

3. Michiel Le Roux

Nationality: South African

Bank founded: Capitec Bank

Net Worth: $3.5 billion

Michiel Le Roux, South Africa’s wealthiest banker, co-founded Capitec Bank in 2001 and steered its evolution into a powerhouse of financial empowerment for the middle class. As Chairman from 2007 to 2016, Le Roux laid a foundation built on simplicity, accessibility, and trust that resonated with millions, transforming everyday banking. His strategic foresight not only propelled Capitec into becoming a dominant force in the Stellenbosch-based institution but also ensured its resilience in a competitive market. Le Roux’s personal fortune, anchored by an 11.34 percent stake in Capitec Bank, worth R57.92 billion ($3.62 billion), reflects his commitment to sustainable growth and innovation. His journey underscores the impact of visionary leadership in democratizing finance and fostering economic empowerment across South Africa.

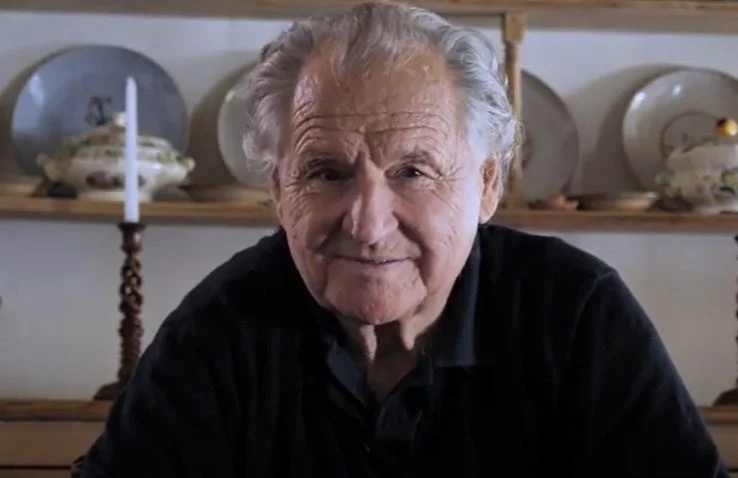

4. Jannie Mouton

Nationality: South Africa

Net Worth:$2.5 billion

Jannie Mouton, born in South Africa, is a well-known entrepreneur and the founder of PSG Group, a varied investment holding firm engaged in financial services, banking, private equity, agriculture, and education. He was a co-founder of Capitec Bank, which has become one of South Africa’s top retail banks. He presently owns a 5.10% stake in Capitec Bank, equivalent to 5,917,727 shares, through his Jf Mouton Familietrust. This is currently worth R26.04 billion ($1.63 billion) as of report writing. Referred to as the “Buddha Buffett,” Mouton started his journey as an articled clerk at PwC and became a chartered accountant in 1973. In 1995, at the age of 48, he was dismissed by his partners at Senekal, Mouton & Kitshoff, a brokerage he helped establish. This challenge prompted him to create PSG Group. His children are on PSG’s board, with Piet Mouton serving as CEO.

5. Othman Benjelloun

Bank founded: BMCE Bank of Africa

Net Worth: $1.9 billion

Nationality: Morocco

Othman Benjelloun is a renowned Moroccan financier and the chief executive officer of BMCE Bank of Africa, which operates in more than 20 African nations. His leadership extends beyond Africa, with a strategic presence in Europe through a representative office in Paris. A seasoned financier, Benjelloun commands over 27% stake in Bank of Africa. Under his stewardship, BMCE Bank’s market capitalization has soared closer to $5 billion, cementing its status as a financial powerhouse. His influence extends beyond banking. Through RMA Watanya, he has a strong foothold in Morocco’s insurance market. Meanwhile, his strategic partnerships with Volvo and General Motors have diversified his holdings, reinforcing his stature as one of Africa’s most astute investors. His legacy is one of calculated expansion and enduring financial influence.

6. Tony Elumelu

Nationality: Nigeria

Net Worth: $700 million

Tony Elumelu is a notable economist, banker and charitable figure. He presides over Heirs Holdings, Transcorp, and the United Bank for Africa (UBA). In 1997, he rose to fame by guiding a team of investors to acquire a failing commercial bank in Lagos, making it profitable in just a few years. In 2005, he consolidated it with UBA, which currently functions in more than 20 African nations, the U.S., and the U.K. Besides banking, Elumelu has a majority share in Transcorp, a Nigerian conglomerate involved in hospitality, agriculture, oil, and energy. He additionally possesses real estate properties and a minority ownership in MTN Nigeria. Through The Tony Elumelu Foundation, he champions “Africapitalism,” advocating private sector-led economic transformation in Africa.

7. Laurie Dippenaar

Nationality: South African

Net Worth: $610 million

Bank founded: FirstRand

Laurie Dippenaar is a towering figure in South Africa’s financial sector, with a legacy spanning nearly five decades. In 1977, alongside GT Ferreira and Paul Harris, he co-founded Rand Consolidated Investments, a move that set the stage for the creation of FirstRand, now Africa’s most valuable financial services group. Through strategic mergers, including the 1998 combination of First National Bank, Rand Merchant Bank, and Momentum, FirstRand evolved into a powerhouse with a vast footprint across retail, corporate, and investment banking. His leadership and investment acumen have cemented FirstRand’s dominance in the continent’s financial landscape, shaping the industry for generations to come.

8. Jim Ovia

Nationality: Nigerian

Net Worth: $550 million

Bank founded: Zenith Bank Plc

Jim Ovia is the visionary founder and Chairman of Zenith Bank Plc, Nigeria’s largest commercial bank by market capitalization. With over 16% stake in the institution, he stands as one of the most influential investors on the Nigerian Exchange. Since establishing Zenith Bank in 1990, Ovia has revolutionized Nigeria’s financial sector, introducing cutting-edge banking technology and setting industry benchmarks for corporate governance and customer service. Under his leadership, Zenith Bank has grown from a fledgling institution into a powerhouse. As of September 30, 2025, Zenith Bank PLC reported total assets of N31.18 trillion ($22.78 billion), representing a 4.1% growth from the N29.96 trillion ($21.88 billion) recorded at the end of December 2024.

9. Tshepo Mahloele

Nationality: South African

Financial services focus: Harith General Partners / Capitec Bank

Stake in Capitec is worth over $2 billion

Tshepo Mahloele has emerged as one of South Africa’s most influential investment professionals, building long-term wealth through disciplined infrastructure investing and strategic financial holdings. Best known as the founding chief executive of Harith General Partners, Mahloele helped position the firm as a leading Pan-African infrastructure investor, backing assets across energy, transport, and digital infrastructure. Beyond Harith, his growing influence in South Africa’s banking sector is anchored in his nearly 7% indirect stake in Capitec Bank, the country’s largest retail lender by market value. That holding has surged in value above $2 billion this year, 2026, pushing Mahloele into the ranks of South Africa’s wealthiest banking-billionaires and investors. Known for a low-profile but highly effective investment style, Mahloele’s influence lies in quietly shaping capital flows into Africa’s real economy, cementing his reputation as a builder of enduring financial value rather than a headline-seeking financier.

10. Adrian Gore

Nationality: South African

Net Worth: $480 million

Company founded: Discovery Limited

Adrian Gore is one of the most influential innovators in South Africa’s financial and healthcare sectors, best known as the founder and chief architect of Discovery Limited. In 1992, Gore launched Discovery as a health insurer with a radically different model, one that linked human behavior to insurance outcomes. Discovery Limited commands a market valuation of R162 billion ($10.07 billion), making it one of the continent’s most valuable insurance and financial services firms. Discovery Health manages roughly $11 billion in assets and is Africa’s most innovative health insurer. Its behavior-based insurance model has reshaped how healthcare risk is priced and managed.

11. Hitesh Anadkat

Nationality: Malawian

Bank Founded: FMB Capital Holdings

Indian-Malawian financier Hitesh Anadkat has cemented his dominance in Malawi’s banking sector through FMB Capital Holdings, a financial powerhouse he founded in 1995. Initially launched as First Merchant Bank, the Mauritius-based firm has expanded its footprint across multiple African markets, leveraging Anadkat’s strategic foresight and aggressive expansion plans. Under his leadership, FMB Capital has evolved into Malawi’s premier financial institution, attracting investors with strong earnings and market resilience.

12. Thomson Mpinganjira

Nationality: Malawian

Bank founded: FDH Bank

Thom Mpinganjira, a towering figure in Malawi’s financial sector, built his empire through FDH Bank Plc, one of the country’s largest commercial banks. Listed on the Malawi Stock Exchange (MSE), FDH Bank has been a cornerstone of his wealth and influence. Mpinganjira, through his investment vehicle M Development Ltd., holds an indirect 40.7-percent stake in the bank. His journey to financial prominence began in 2007 when he founded FDH Financial Holdings, leading its aggressive expansion into banking, insurance, and capital markets. Under his leadership, FDH Bank became a dominant force, leveraging digital banking innovations and a strategic acquisition of Malawi Savings Bank in 2015.

13. Idrissa Nassa

Nationality: Burkinabe

Bank founded: Coris Bank International

Burkinabe financier Idrissa Nassa, founder of Coris Bank International, has built one of WAEMU’s top three banking groups. From selling goods in Ouagadougou’s grand market in 1984 to leading a financial empire, his rise embodies African entrepreneurship. Since its 2008 launch, Coris Bank—63.6 percent owned by Coris Holdings—has expanded into 10 African markets, commanding 20 percent of Burkina Faso’s banking sector and 8.8 percent across WAEMU. Its flagship subsidiary, Coris Bank Burkina Faso, listed on the BRVM, remains highly profitable. Beyond banking, Nassa’s investments span hospitality (Sopatel), real estate, printing, and agro-food (Afridia Industries, producer of Malia juices). His family fully controls Coris Holding, with Nassa personally owning 98 percent. His leadership has cemented Coris Bank’s dominance in African finance, making him one of Burkina Faso’s wealthiest figures.

14. Samuel Foyou

Nationality: Cameroonian

Bank Founded: Africa Golden Bank

Cameroonian billionaire Samuel Foyou, the founder of Africa Golden Bank, has made a bold entry into the financial sector with the launch of his bank in 2024. Licensed by the Central African Banking Commission (Cobac) in 2023, Africa Golden Bank has begun limited operations in Douala, Cameroon’s economic hub. The bank’s entry marks Foyou’s expansion beyond his diversified business empire, which spans industries such as brewing, manufacturing, hospitality, and food processing under the Foyou Group. With Africa Golden Bank set to become Cameroon’s 19th licensed banking institution and the eighth controlled by domestic capital, Foyou’s influence in the local economy continues to grow. His expansion into banking is expected to intensify competition among domestic and foreign financial institutions, benefiting consumers with greater financial product offerings. Foyou’s business acumen was further highlighted in 2021 when he unveiled Cameroon’s second five-star hotel, a CFA16 billion ($27.5 million) luxury establishment in Douala.

15. Suresh Bhagwanji Shah

Nationality: Kenyan

Bank founded: I&M Bank Group

Suresh Bhagwanji Shah, the visionary behind I&M Bank Group, has built one of East Africa’s most leading banking institutions, with a footprint spanning Kenya, Tanzania, Rwanda, and Mauritius. His over 10 percent stake in the bank, cements his status as one of Kenya’s most influential financiers. Beyond I&M Bank, Shah has strategically diversified his wealth through MTZ Holdings, an investment vehicle that plays a pivotal role in expanding financial access across the region. Shah’s legacy extends beyond numbers. His leadership has transformed I&M Bank from a modest financial institution into a regional powerhouse, shaping the evolution of East Africa’s banking sector. With decades of experience, his influence continues to drive innovation, making him a defining figure in the region’s financial industry.

16. James Mwangi

Nationality: Kenyan

Bank led: Equity Group Holdings

James Mwangi stands as one of Africa’s most influential banking leaders, having transformed Equity Group from a small building society into East and Central Africa’s most expansive financial services group. Appointed CEO in 2004, Mwangi led the conversion of Equity Building Society into Equity Bank, pioneering a mass-market banking model that brought millions of previously unbanked Africans into the formal financial system. Under his leadership, Equity expanded beyond Kenya into Uganda, Tanzania, Rwanda, South Sudan and the Democratic Republic of Congo, building a pan-African footprint anchored on digital banking and financial inclusion. Today, Equity Group ranks among Africa’s largest banks by customer base, serving over 19 million clients. Mwangi remains a central shareholder and strategic force within the group.

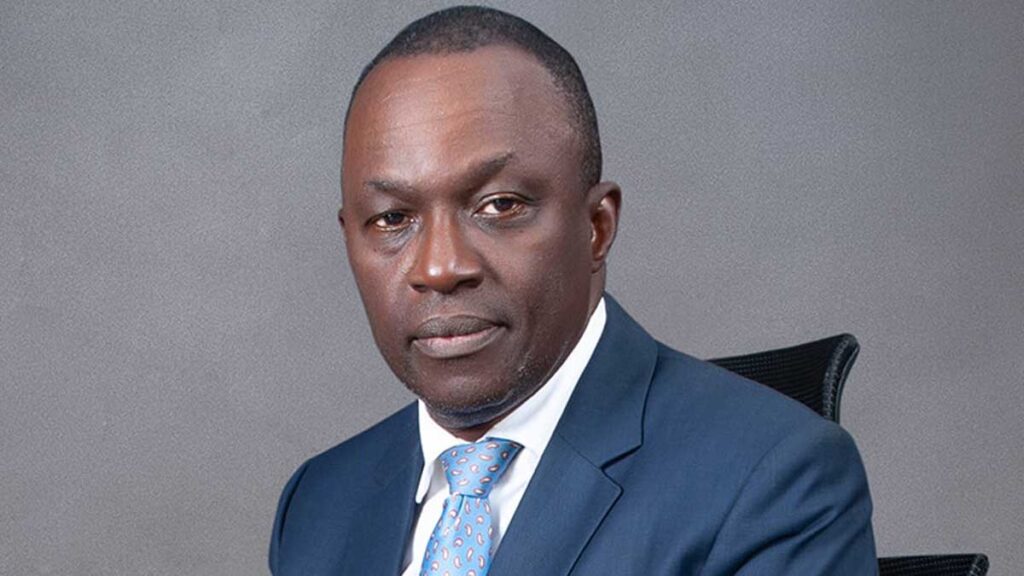

17. Patrick Tumbo

Nationality: Kenya

Patrick Tumbo, CEO of Sanlam Kenya PLC with over 30 years of experience. He has played a key role in guiding the company through difficult financial times. In 2022, Sanlam Kenya, under his guidance, reported a loss after tax of Ksh127 million, caused by elevated interest rates and rising financing expenses. In reply, Tumbo employed a financial engineering approach designed to boost growth and profitability. This strategy resulted in significant gains for the company’s subsidiaries. Moreover, in 2023, Sanlam Kenya became a member of the UN Global Compact, reinforcing its dedication to sustainable business practices under the leadership of Tumbo.

18. Atedo Peterside

Nationality: Nigeria

Atedo Peterside is a distinguished Nigerian businessman and economist celebrated for his groundbreaking influence on the nation’s banking industry. At 33 years old, he established Investment Banking & Trust Company Limited (IBTC) in 1989, which eventually merged with Stanbic Bank Nigeria in 2007 to create Stanbic IBTC Bank PLC. Peterside was the founding CEO until 2007 and later became Chairman until 2014. In addition to his banking role, he led the committee responsible for creating Nigeria’s inaugural Code of Best Practices for Public Companies in 2003. In May 2022, Peterside was honored with the Lifetime Achievement Award at the African Banker Awards for his valuable contributions to the banking sector. He is the Founder and President of Anap Foundation, a non-profit organization dedicated to encouraging good governance.

19. Tidjane Thiam

Nationality: Côte d’Ivoire

Tidjane Thiam was born in Abidjan, Côte d’Ivoire, and is a prominent Ivorian-French entrepreneur celebrated for his revolutionary management in the international finance industry. In 2009, he made history by becoming the first Black CEO of an FTSE 100 firm when he assumed leadership at Prudential plc, holding the position until 2015. Thiam subsequently served as CEO of Credit Suisse from 2015 to 2020, executing a successful overhaul that redirected the bank’s focus toward wealth management and emerging markets. His contributions were acknowledged in 2018 when Euromoney awarded him the title “Banker of the Year.” Apart from corporate positions, Thiam has played a role in international development, leading the G20’s High Level Panel on Infrastructure Investment in 2011 and being a member of the Africa Progress Panel. He received the honor of being designated a Chevalier of the French Légion d’honneur in 2011.

20. Mohamed Hassan Bensalah

Nationality: Morocco

Mohamed Hassan Bensalah serves as the Chairman and CEO of Holmarcom Group, a prominent Moroccan conglomerate well-established in the insurance industry. Assuming control in 1993 at the age of 23, he turned Holmarcom into a key player in African insurance. Under his guidance, the group increased its investment in Atlanta Insurance, now its biggest asset, enhancing its market impact. In 2021, he led the purchase of Kenya’s Monarch Insurance, signifying a daring movement into East Africa’s insurance sector. Holmarcom’s purchase of Crédit du Maroc in 2023 further strengthened its presence in financial services. In his role as President of the Moroccan Federation of Insurance and Reinsurance Companies (FMSAR), Bensalah has advocated for regulatory changes and promoted growth within the sector.

21. Patrick Robert Enthoven

Nationality: South Africa

Patrick Robert Enthoven is a South African insurance broker famous for establishing the Hollard Group, the largest privately held insurance conglomerate in the nation. Alongside his father, Robert Enthoven, he founded Hollard in 1980, naming it after Hollard Street in Johannesburg, where the stock exchange is located, to convey an impression of respectability. During his tenure, Hollard grew its operations outside South Africa, broadening its presence to nations like Namibia, Mozambique, Botswana, Australia, India, Pakistan, China, Ghana, and the United Kingdom. In 2011, Patrick’s son, Dick Enthoven, took over as chairman of the Hollard Group, upholding the family’s heritage in the insurance field.

22. Wole Oshin

Holdings: Custodian Investment Plc

Wole Oshin founded Custodian Investment Plc in 1991. The company has active operations in the Nigerian financial services sector, mainly through its insurance subsidiaries and investments in the country’s real estate sector. Oshin owns a 26.81-percent stake in Custodian Insurance worth $13.75 million. With a N229.4 billion market capitalization, Custodian Investment anchors one of Nigeria’s most diversified insurance and pension groups, benefiting from steady institutional mandates and disciplined balance-sheet management.

23. Kessington Adebutu

Holdings: Wema Bank

Nigerian lotto magnate Kessington Adebutu is the beneficial owner of Neemtree Investments, which controls 28.09 percent of Wema Bank. The shares are worth $22.79 million. While marking his 90th birthday in 2025, the gambling magnate donated $2.7 million to fund education, health, and infrastructure in Remoland.

24. Muhammadu Indimi

Holdings: Jaiz Bank

The Nigerian oil tycoon is the largest shareholder in Jaiz Bank, a financial services institution that operates under Islamic banking principles. He owns a 24.06-percent stake worth $16.34 million.

25. Ashraf Sabry

Holdings: Fawry for Banking Technology and Electronic Payments S.A.E

Ashraf Sabry serves as CEO and Managing Director of Fawry, Egypt’s leading fintech company. Since joining, he has played a pivotal role in expanding Fawry’s network to nearly 400,000 agents and 36 banking partners, supporting millions of users across Egypt. Sabry holds a 2.345 percent stake in Fawry, reflecting a personal investment in the company’s growth and strategic direction. With Fawry’s market leadership in electronic payments, SME financing, and collections, Sabry oversees one of Africa’s most influential digital payments platforms, driving adoption and shaping Egypt’s evolving fintech ecosystem.