At a Glance:

- Record-breaking M&A deals are reshaping Africa’s industries, fueling sectoral growth, and attracting global investors.

- Mega acquisitions in energy, telecom, and mining signal Africa’s emergence as a high-growth investment frontier.

- Regulatory shifts and market dynamics are driving sustained M&A activity across key African sectors.

Africa’s mergers and acquisitions (M&A) landscape has witnessed unprecedented deal-making, reshaping industries and positioning the continent as a high-growth investment frontier.

From energy and telecommunications to mining and retail, multi-billion-dollar transactions have fueled sectoral expansion, enhanced market competitiveness, and attracted global investors.

With shifting regulatory landscapes and evolving market dynamics, Africa is emerging as a prime investment destination.

The continent’s M&A activity signals a maturing business environment, where local and multinational firms are aggressively expanding their footprint.

As dealmaking accelerates, understanding the largest and most influential M&A transactions offers critical insights into Africa’s economic trajectory.

Here’s a look at the ten largest M&A deals that have redefined Africa’s economic landscape and corporate power dynamics.

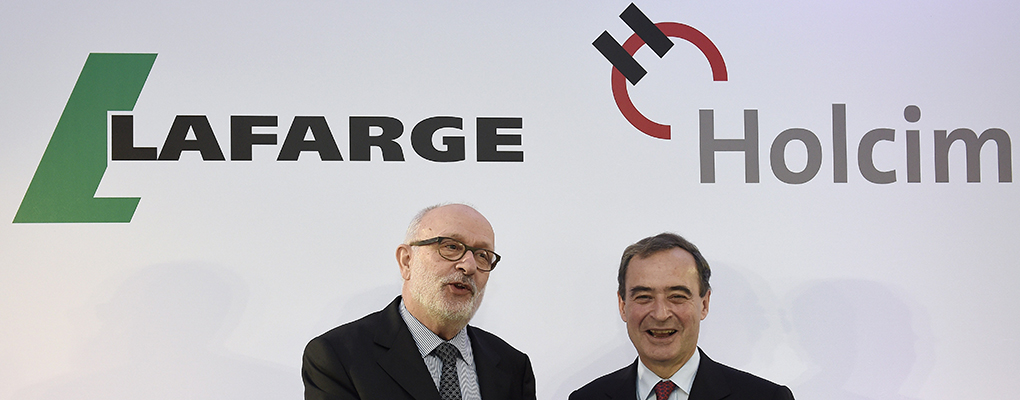

Holcim-Lafarge Merger ($44 Billion)

In 2015, Swiss cement giant Holcim merged with France’s Lafarge in a $44 billion deal, creating LafargeHolcim—the world’s largest cement producer.

The transaction was aimed at expanding global reach and operational efficiency while driving sustainability initiatives.

However, regulatory hurdles necessitated asset divestitures in key markets like the U.S., Canada, and India.

Rebranded as Holcim in 2021, the company pivoted towards green building materials and innovative construction technologies.

Glencore’s Takeover of Xstrata ($30 Billion)

In 2013, commodities powerhouse Glencore acquired Xstrata in a $30 billion deal, forming one of the world’s largest diversified natural resource firms.

The transaction faced governance disputes and regulatory scrutiny but ultimately positioned Glencore as a dominant force in mining and commodities trading.

Despite initial integration challenges, Glencore’s strategy to consolidate trading and mining operations enhanced supply chain efficiencies and market influence.

Bharti Airtel’s Acquisition of Zain Africa ($10.7 Billion)

India’s Bharti Airtel made a significant play in Africa’s telecom sector by acquiring Zain Africa for $10.7 billion in 2010.

The deal, excluding Sudan and Morocco operations, granted Bharti access to 15 African markets, including Nigeria, Kenya, Ghana, and Uganda.

This strategic expansion strengthened its footprint in Africa’s fast-growing mobile industry, intensifying competition with MTN and other regional players.

Barrick Gold’s Merger with Randgold Resources ($6.5 Billion)

Barrick Gold’s 2019 all-share merger with Randgold Resources, valued at $6.5 billion, reshaped the global gold mining landscape.

The deal combined Barrick’s extensive North American assets with Randgold’s high-yield African mines, creating the world’s largest gold producer at the time.

The move bolstered Barrick’s operational scale while enhancing its exposure to high-quality assets in key African markets.

Heineken’s Merger with Distell and Namibia Breweries ($2.6 Billion)

In April 2023, Heineken completed the $2.6 billion acquisition of Distell Group Holdings and Namibia Breweries, consolidating its presence in Southern Africa.

These entities merged with Heineken South Africa to form Heineken Beverages, reinforcing the company’s market dominance and expanding its premium beverage portfolio across the continent.

Walmart’s Acquisition of Massmart ($2.4 Billion)

Retail behemoth Walmart entered Africa in 2011 through a $2.4 billion deal to acquire a 51% stake in South African retailer Massmart.

The acquisition, granting Walmart access to 13 African countries, marked a significant foray into emerging markets.

Despite regulatory challenges and labor concerns, Walmart leveraged Massmart’s established distribution networks to drive its low-cost, high-volume strategy.

Renaissance Capital’s Acquisition of SPDC ($1.3 Billion)

Emerging markets investment firm Renaissance Capital executed a strategic $1.3 billion acquisition of Shell Petroleum Development Company (SPDC) in Nigeria.

The deal aligned with the broader trend of oil majors divesting onshore assets in the Niger Delta due to security risks and regulatory pressures.

This acquisition positioned Renaissance to capitalize on Nigeria’s vast energy potential while navigating geopolitical complexities.

Seplat Energy’s Acquisition of MPNU ($1.3 Billion)

Seplat Energy, a leading Nigerian oil and gas firm, made headlines with its $1.3 billion acquisition of Mobil Producing Nigeria Unlimited (MPNU) from ExxonMobil.

Initially delayed by regulatory approvals, the transaction underscored the growing influence of indigenous companies in Nigeria’s upstream sector.

By securing MPNU’s prolific offshore assets, Seplat bolstered its production capacity and strengthened its role in West Africa’s energy ecosystem.

Chappal Energies’ Acquisition of TotalEnergies’ Assets ($850 Million)

Chappal Energies expanded its footprint in Nigeria’s energy sector with an $850 million acquisition of a significant asset portfolio from TotalEnergies.

This deal highlighted TotalEnergies’ strategic divestment from onshore assets to focus on offshore and renewables.

For Chappal Energies, the acquisition reinforced Nigeria’s local content agenda and ensured continued investment in critical upstream assets.

Oando’s Acquisition of NAOC ($783 Million)

In August 2024, Oando PLC acquired the Nigerian Agip Oil Company (NAOC) from Italy’s Eni for $783 million, doubling its participating interests in key oil blocks from 20% to 40%.

The deal expanded Oando’s asset base to include 40 discovered oil and gas fields, 12 production stations, 1,490 kilometers of pipelines, three gas processing plants, and a power generation capacity of 960 megawatts.

This acquisition reinforced Oando’s position as a leading player in Nigeria’s evolving energy sector.

A new era for M&A in Africa

These landmark mergers and acquisitions have reshaped Africa’s business landscape, driving sectoral growth and attracting global investment.

As regulatory frameworks evolve and market dynamics shift, M&A activity is set to remain a critical driver of economic transformation across the continent.

With industries like energy, mining, and telecommunications at the forefront, Africa continues to present lucrative opportunities for investors and corporate giants alike.