At a Glance

- ElSewedy’s 2024 revenue soared over 50% to EGP231.98 billion ($4.58 billion), with record net profit.

- The billionaire El-Sewedy family holds over 79% of the company, a stake now valued above $2.75 billion—cementing their status among Egypt’s wealthiest.

- Expanding in Africa, renewables, and textiles with strong investor and market confidence.

In Egypt’s bustling industrial landscape, ElSewedy Electric has emerged as the sector’s crown jewel. With EGP 172 billion ($3.47 billion) market capitalization, it now ranks as the most valuable industrially focused company in the country, signaling both deep-rooted heritage and forward-looking strategy.

From local cable maker to industrial heavyweight

What started in 1938 as a small Cairo-based cable factory has grown into a major force in energy transmission and industrial infrastructure across Africa and the Middle East.

ElSewedy now operates 15,000–19,000 employees across 31 production facilities in 15 countries, exporting to over 110 markets.

With a diverse portfolio that includes power generation, smart metering, and renewable energy projects, it has become a standout choice for investors seeking long-term growth opportunities in the region.

A sharp jump in market value

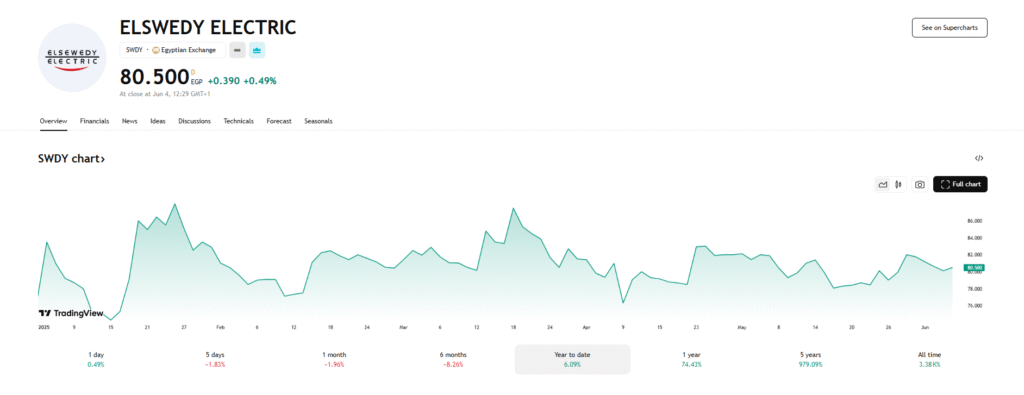

Elswedy Electric’s stock has gained 6.15 percent so far in 2025, rising from EGP 75.88 to EGP 80.50. Despite currency devaluation dampening dollar-based returns, the company’s valuation surged from just over $2 billion to about $3.5 billion—underscoring strong investor confidence.

As of June 6, 2025, Shore Africa reports that Elswedy Electric’s share price stood at EGP 80.50, with a market capitalization of $3.47 billion.

Billionaire El-Sewedy family stake hits $2.75 billion

The El‑Sewedy family’s dominance persists, holding nearly 79 percent of shares—a stake valued at upward of $2.75 billion based on current prices.

Azza El-Sewedy, one of the leading female investors on the Egyptian Exchange and sister to the billionaire El-Sewedy brothers, who holds a beneficial 3.03 percent stake—equivalent to 64.92 million shares—has seen her investment in Elsewedy Electric grow by more than $5 million in 2025 to EGP5.22 billion ($105.2 million).

Ahmed El-Sewedy, the company’s CEO, holds a 25.52 percent stake—equivalent to 546,252,820 shares has seen his stake increased by more than $50 million to EGP44 billion ($886.64 million).

Meanwhile, his brother, Sadek El-Sewedy, who serves as non-executive chairman, holds a 25.53 percent stake, or 546,502,820 shares. His holdings have also gained over $50 million to EGP43.99 billion ($886.5 million).

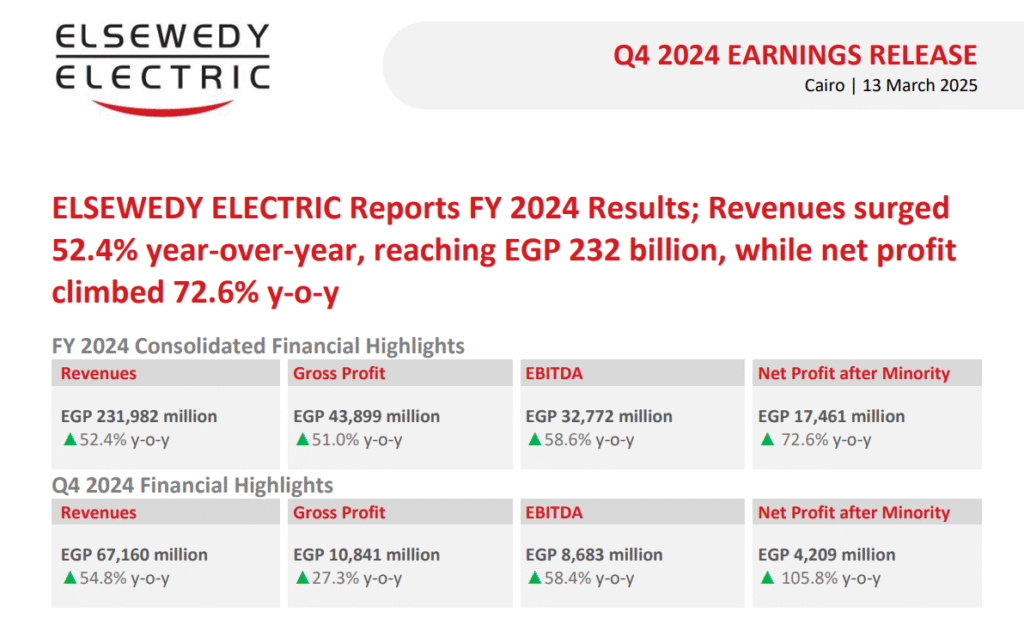

Elsewedy Electric posts record 2024 earnings

In the 2024 fiscal year, Elsewedy Electric delivered record-breaking results, with total revenue soaring 50.2 percent to EGP231.98 billion ($4.58 billion). Net profit surged 72.6 percent year-on-year to EGP17.46 billion ($344.74 million), reflecting the company’s resilience amid inflationary pressures and currency volatility, and its agility in seizing market opportunities.

Elsewedy’s total assets expanded significantly, climbing 64.8 percent to EGP249.53 billion ($4.93 billion) by December 31, up from EGP151.45 billion ($2.99 billion) at the end of 2023. The company also recorded strong growth in total equity and retained earnings, which rose 56.2 percent and 49.4 percent to EGP44.62 billion ($880.93 million) and EGP59.53 billion ($1.18 billion), respectively.

Driving growth: core segments and strategic expansions

Elsewedy Electric’s growth is driven by strong performance in core electrical infrastructure, including sustained demand for cables, transformers, and power equipment across Egypt and MENA.

The firm is also expanding into renewables and smart technologies, earning a spot on Time Magazine’s 2025 list of the World’s Best Companies in Sustainable Growth—ranking 298th and standing out as the only Middle Eastern and African firm in its sector.

Internationally, Elsewedy is executing projects in Saudi Arabia, Libya, and Africa, including a $870 million power plant in Zliten. In January 2025, it signed a $60 million textile factory deal in Sadat City.

Positioned for future opportunity

ElSewedy’s impressive valuation is grounded in solid growth metrics—not speculative promise. With a forward P/E under 9x, strong sales momentum, expanding geographical and product footprint, and strategic diversification, the company is poised for long-term industrial leadership. Its role in Egypt’s energy infrastructure development, plus recent moves into textiles and renewables, signals a robust and multifaceted growth strategy.

ElSewedy Electric’s rise to a $3.47 billion valuation is more than a stock-market milestone—it reflects decades of expansion, disciplined execution, and family-led governance. In Egypt’s industrial economy, ElSewedy now stands as a model of scale, innovation, and sustainable growth.