At a Glance

- Profit fell 83% to $15 million on $195 million Swiss asset impairments and weak performance.

- Revenue climbed 4.92% to $4.82 billion on rising inpatient admissions and day-case growth.

- Southern Africa and Middle East posted strong gains, offsetting Swiss operational slump.

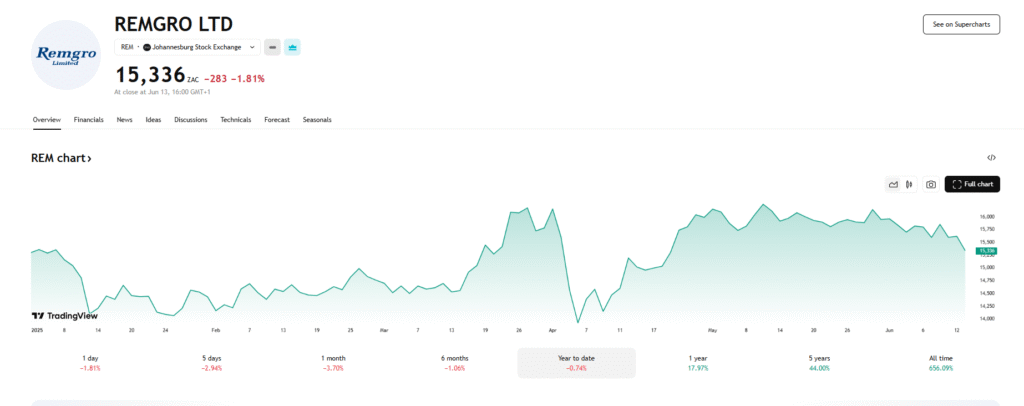

Manta Bidco, a healthcare services group under Remgro led by billionaire Johann Rupert, reported a double-digit profit slump for the year ended March 31, 2025, as impairments in its Swiss operations triggered a $75 million decline in earnings—despite a 4.92 percent rise in revenue to more than $4.8 billion.

Profit plunges 83% on Swiss impairments despite revenue growth

According to its recently released report, Manta Bidco—incorporated primarily to consolidate Mediclinic business and its entire holding—reported an 83.33 percent drop in full-year profit to $15 million for the period ending March 31, 2025, down from $90 million a year earlier.

The decline was driven by significant impairments in its Swiss operations, where operating profit fell 48 percent to $127 million due to substantial charges and weak market performance.

Revenue climbs 4.9% amid Swiss drag

Despite the Swiss headwinds, group revenue rose 4.92 percent to $4.82 billion, up from $4.59 billion in FY 2024. Growth was supported by a 1.5 percent increase in inpatient admissions and a 3.2 percent rise in day cases.

The Swiss unit recorded a $196 million loss for the year—steeply down from a $27 million loss in FY 2024—dragged by impairments of $195 million in property, plant and equipment, and $84 million in intangible assets. Management flagged ongoing challenges in the region, including pricing pressure and regulatory costs, and is implementing operational restructuring to stabilize performance.

Elsewhere, Southern Africa and the Middle East delivered stronger results. Profit in Southern Africa climbed to $94 million from $78 million, while the Middle East unit posted a $103 million profit, up from $83 million. Spire returned to profitability, contributing $10 million after a $35 million profit the previous year, though that 71 percent drop signals a tough market.

Despite the Swiss drag, Manta Bidco maintained steady growth across core markets, underscoring resilience amid economic uncertainty. The group plans to continue investing in digital health infrastructure and expanding its presence in high-growth regions.

Mediclinic hit by currency losses, market pressure

Remgro, chaired by billionaire Johann Rupert, has strengthened its healthcare portfolio through Manta Bidco, jointly owned with MSC Mediterranean Shipping Company. The consortium’s acquisition and delisting of Mediclinic International underline its strategic value to the group.

As of March 31, 2025, total assets dipped 1.42 percent to $9.78 billion from $9.92 billion a year earlier. Equity also edged down 0.12 percent to $4.92 billion, reflecting a $6 million hit from currency translation losses. The group’s performance highlights the pressures of an evolving healthcare market, even as it remains focused on delivering long-term value to shareholders.