At a Glance

- Mantengu acquires Blue Ridge and Sheba’s Ridge to expand in South Africa’s PGM sector.

- Acquisition boosts Mantengu’s role in clean energy mineral supply and beneficiation strategy.

- Sheba’s Ridge to anchor Mantengu’s platinum production with ESG and local engagement focus.

Mantengu Mining Ltd, the Johannesburg-listed investment holding company chaired by South African executive Jonas Tshikundamalema, has finalized the acquisition of Blue Ridge Platinum and Sheba’s Ridge from a consortium including Corridor Mining Resources and AfroCentric Investment Corporation for a total of R3 billion ($170.34 million).

The deal, first unveiled in 2024, was approved by the boards and regulatory stakeholders involved and marks Mantengu’s full-scale entry into the platinum group metals (PGM) sector.

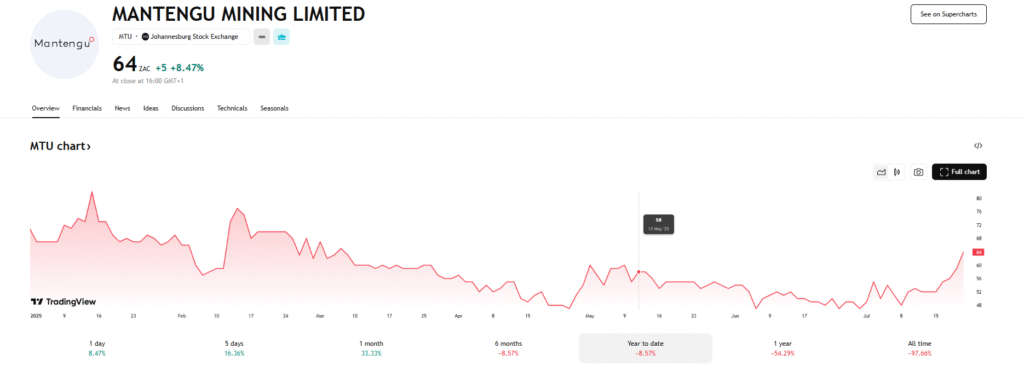

The acquisition includes mining rights, infrastructure, and related assets, positioning Mantengu to capitalize on global demand for critical minerals used in clean energy technologies. With a market capitalization of R203 million ($11.52 million).

Blue Ridge Platinum joins Mantengu’s portfolio

With the deal now complete, Blue Ridge Platinum and Sheba’s Ridge become part of Mantengu’s core mining portfolio. The company plans to leverage the high-grade deposits to build a scalable, sustainable operation aligned with South Africa’s mineral beneficiation strategy.

“This acquisition is a pivotal step in Mantengu’s evolution from a restructuring entity to a growth-driven mining company,” said Mokoena. “It unlocks significant value and supports our long-term vision of contributing to South Africa’s industrial and energy transition.”

Sheba’s Ridge positioned as growth engine

The Sheba’s Ridge asset—containing platinum, palladium, rhodium, and associated base metals—will serve as the cornerstone of Mantengu’s future production.

Mantengu expects to initiate a phased development plan that includes community engagement, ESG compliance, and strategic offtake partnerships.

“We are not just acquiring assets—we’re building an ecosystem of inclusive growth, industrialization, and beneficiation,” added Mokoena.

In the 2024 fiscal year, Mantengu’s profit surged 25,913 percent from R1.17 million ($66,160) to R303.31 million ($17.21 million), while revenue jumped 188.9 percent from R109.9 million ($6.24 million) to R317.5 million ($18.02 million). Total assets also grew 145.6 percent, rising from R451.21 million ($25.6 million) to R1.11 billion ($62.87 million).

Mantengu’s pivot backed by restructuring success

Listed on the Johannesburg Stock Exchange, Mantengu emerged from a business rescue process with a focused strategy to build a multi-commodity mining company. Its latest move follows successful restructuring and capitalization efforts over the past two years.

The acquisition signals a bold shift in strategy and underscores the company’s intent to become a key player in South Africa’s mining renaissance.