At a Glance

- Dangote Cement H1 profit rose 174% to $340.27 million, underscoring market leadership in Nigeria.

- Nigerian revenue climbed 45.5% to $943 million, boosted by higher prices and resilient demand.

- Production volume rose to 6.59 million tonnes, despite slight dip in cement and clinker sales.

Dangote Cement Plc, Africa’s largest cement producer controlled by billionaire Aliko Dangote, reported a robust 17.7 percent revenue increase to nearly $1.4 billion in the first half of 2025, building on strong momentum from the first quarter.

The increase was fueled by strong demand across Nigeria and key African markets, driven by ongoing investments in housing, commercial developments, and cross-border infrastructure upgrades that have supported the construction materials sector.

Dangote Cement revenue climbs 17.7% as profit nearly triples

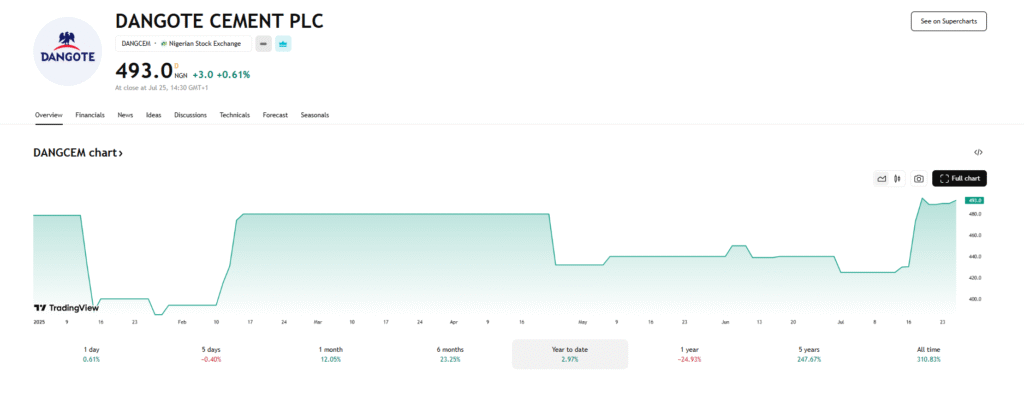

The company’s recently released financial report shows that Africa’s largest cement maker, posted a 17.7 percent revenue increase to N2.07 trillion ($1.35 billion) in the first half of 2025, up from N1.76 trillion ($1.15 billion) a year earlier.

Net income surged 174.1 percent to N520.46 billion ($340.27 million), underscoring the company’s sustained dominance in Nigeria’s industrial sector. Earnings per share rose from N11.26 ($0.0074) to N30.74 ($0.0201).

In Nigeria, revenue jumped 45.5 percent to N1.44 trillion ($942.99 million), driven by stronger pricing and resilient demand, despite a slight dip in cement and clinker sales volumes to 8.95 million metric tonnes from 8.99 million tonnes. Production volumes rose to 6.59 million metric tonnes from 6.15 million a year earlier.

Dangote Cement’s assets climb to $4.3 billion

Dangote Cement, 87.45-percent owned by Aliko Dangote, Africa’s richest man with a net worth of $27.5 billion, continues to play a key role in regional trade, exporting cement to markets such as Cameroon, Ghana, and Congo.

The company with a market valuation of N8.32 trillion ($5.44 billion), as chronicled by Shore Africa remains a key player in transforming Nigeria from a cement importer into an exporter within Sub-Saharan Africa.

The cement giant, with an annual production capacity of 52 million tonnes across 10 countries, also saw its total assets rise by 3.34 percent from N6.4 trillion ($4.19 billion) as of Dec. 31, 2024, to N6.62 trillion ($4.33 billion) by June 30, 2025.

However, retained earnings rose modestly by 1.46 percent from N1.027 trillion ($675.53 million) to N1.042 trillion ($681.31 million).