At a Glance

- Kenya launches first oil licensing round in six years with 10 blocks.

- Nairobi offers investor-friendly contracts, tax incentives, and full seismic data access.

- Lamu Port upgrades, crude pipeline plans bolster Kenya’s regional energy ambitions.

Kenya is seeking to reassert itself as a top oil and gas frontier with the launch of its first licensing round in six years, offering 10 high-potential oil exploration blocks for bidding this month.

The move signals Nairobi’s push to attract global upstream investment and accelerate energy sector growth, following sweeping regulatory reforms in its petroleum framework.

The newly announced acreage spans four major sedimentary basins—Lamu, Anza, Mandera, and the Tertiary Rift—cementing Kenya’s positioning as a promising hub for oil and gas exploration in East Africa.

The government, which oversees a total of 50 exploration blocks, has selected these 10 blocks for priority marketing to international oil operators and investors.

Kenya targets global oil operators with basin investments

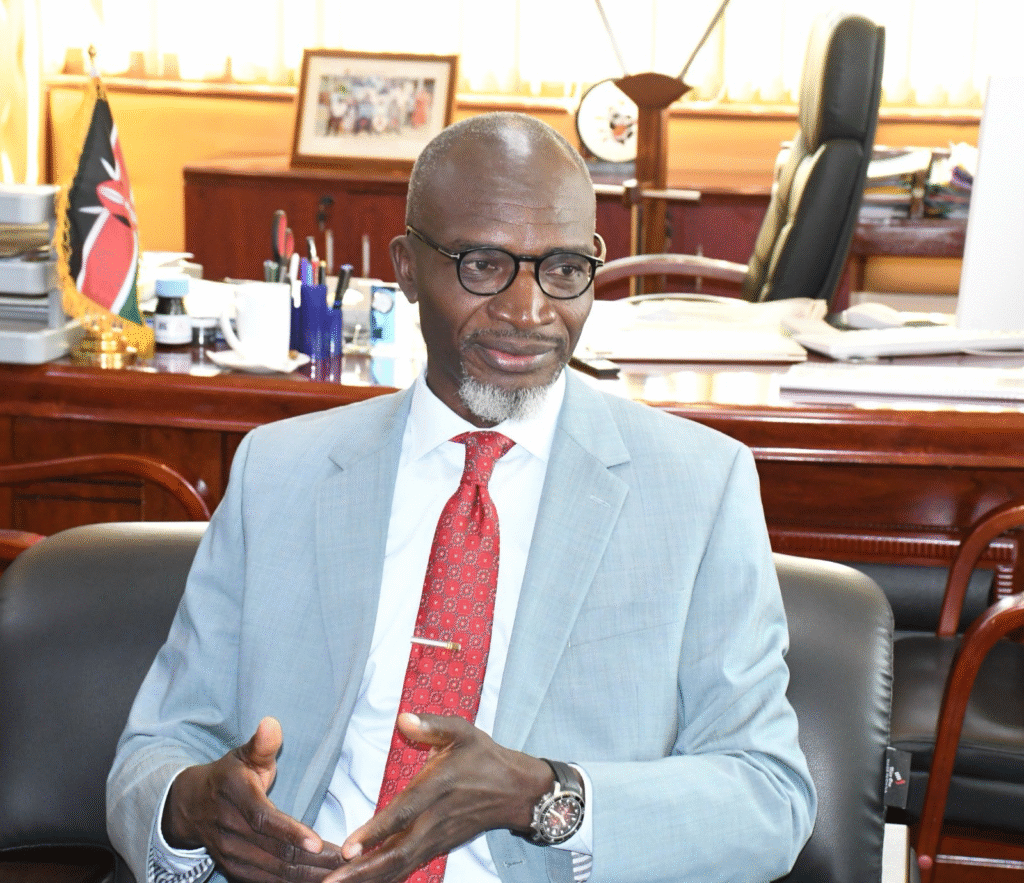

Petroleum Commissioner Joseph Otieno said the Lamu and Anza basins were prioritized based on rigorous geoscientific assessments, with full seismic data, geological surveys, and well reports available to enable transparent investment decisions.

The licensing round reflects Kenya’s shift toward competitive Production Sharing Contracts (PSCs) and tax incentives that align with international standards to lure multinational oil companies.

At the East African Petroleum Conference & Exhibition 2025 in Dar es Salaam, Energy Cabinet Secretary Opiyo Wandayi emphasized Kenya’s long-term commitment to its oil and gas sector, unveiling infrastructure upgrades to the Lamu Port, strategic road networks, and the proposed Lokichar–Lamu Crude Oil Pipeline (LLCOP), a key component of the LAPSSET Corridor project aimed at boosting regional energy exports.

Kenya’s oil sector at a crossroads amid Tullow sale talks

Despite Kenya’s untapped hydrocarbon reserves, oil development has lagged. The South Lokichar Basin project has stalled for years, particularly after TotalEnergies and Africa Oil exited, leaving UK-listed Tullow Oil as the sole operator.

A long-awaited Field Development Plan (FDP) remains pending, but industry insiders suggest Tullow’s Kenya assets are now on the market, potentially opening the door for new players to revive one of East Africa’s most promising energy projects.

By leveraging investor-friendly contracts, enhanced geological data, and multi-billion-dollar infrastructure plans, Kenya aims to position itself as a competitive destination for global oil exploration capital, setting the stage for its next phase of energy growth.