- Centum acquires 85% stake in Akiira Geothermal through $1.8 million partner buyout deal.

- The stalled Rift Valley project awaits revival with new technical partners and financing.

- Akiira holds potential for 70MW geothermal output critical to Kenya’s energy security.

Centum Investment Company, the largest quoted investment company in East Africa, has tightened its grip on Kenya’s Akiira Geothermal project after paying Ksh233 million ($1.8 million) to buy out two foreign partners, raising its ownership to 85 percent in a bid to revive a stalled venture in the Rift Valley.

The Nairobi-based investment firm acquired a 37.5 percent stake from Danish private equity fund DI Frontier for Ksh194 million ($1.5 million) and a smaller stake from U.S. developer RAM Energy for Ksh39 million ($301,645).

The purchases give Centum control of the company, which sits on a Ksh3.5 billion ($27.07 million) balance sheet but has struggled to prove its resource potential after two exploratory wells failed to deliver sufficient steam.

Project setbacks

Launched in the mid-2010s with plans to generate 70 megawatts in its first phase, Akiira Geothermal attracted early backing from international investors and secured grants from the African Union and U.S. agencies.

It even signed a power purchase agreement intent with Kenya Power in 2015, paving the way for lenders such as the European Investment Bank to consider long-term financing.

However, the project stalled after its first drilling near Naivasha delivered disappointing results, casting doubt on the site’s commercial viability. As delays mounted, foreign shareholders scaled back their exposure, setting the stage for Centum’s buyout.

A Search for new partners

Centum, one of East Africa’s largest investment holding groups with interests spanning real estate, private equity and energy, said it is seeking new partners to help unlock the Akiira resource.

With a dominant stake, the firm now has flexibility to restructure the venture, bring in technical expertise from state generator KenGen, and approach development financiers for risk-sharing support.

The move signals Centum’s determination to protect sunk costs while keeping alive the prospect of tapping one of the Rift Valley’s richest renewable resources. Geothermal already supplies more than 40 percent of Kenya’s electricity, and projects like Akiira are viewed as critical to securing baseload power for the grid.

Balancing risk and opportunity

The Ksh3.5 billion book value of Akiira reflects years of exploration spending and grant support, but whether that translates into a bankable asset depends on the success of fresh drilling campaigns. A positive outcome could revive financing prospects and put the 70MW first phase back on track.

Conversely, if further wells confirm limited steam, Centum could be left holding an expensive stranded asset. The relatively modest buyout price underscores the risk calculus: foreign partners chose to exit rather than commit more funds to uncertain geology.

Centum’s next chapter in energy

Listed on the Nairobi Exchange since 1967, Centum has evolved into a diversified powerhouse with stakes in beverages, real estate and infrastructure. As the largest quoted investment company in East Africa with over 38,000 shareholders, its bet on Akiira forms part of a broader energy strategy that once included thermal and wind ventures.

By consolidating ownership of the geothermal project, Centum positions itself to either attract new strategic investors or, if exploration succeeds, become a long-term player in Kenya’s renewable power landscape.

The coming months will determine whether Akiira transforms into a viable baseload project or remains a costly line on Centum’s balance sheet. For now, the buyout signals both a doubling down on risk and a calculated play for control over one of East Africa’s most promising — and challenging — renewable frontiers.

Brief about Centum in 2025

Brief history: Centum is the largest quoted investment company in East Africa with over 38,000 shareholders, and has been listed on the Nairobi Stock Exchange since 1967.

Market Valuation on Nairobi Securities Exchange (NSE): Ksh 9.28 billion ($71.83 million)

Centum Investment Company ranks as the 24th most valuable stock on the NSE, accounting for about 0.3 percent of Kenya’s equity market.

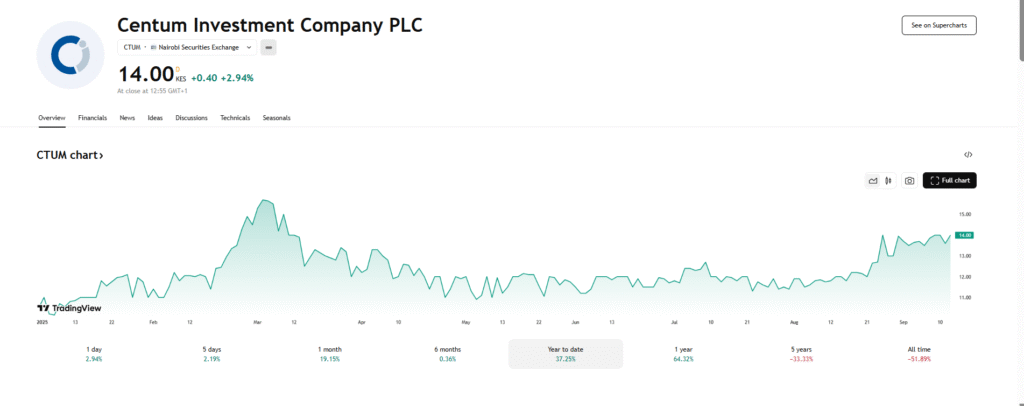

Market watch: If you bought Centum shares at Ksh11 ($0.09) at the start of the year, you’d be up roughly Ksh3 ($0.023) per share today. Back in March, cautious traders could have locked in as much as Ksh4.70 ($0.04) per share in gains.

However, for those holding on the upside may be greater: on July 14, 2025, Centum Investment Company Plc proposed a final dividend of Ksh0.32 ($0.0025) per share for the year ended March 31, 2025. The payout, totaling Ksh210 million ($1.62 million), is subject to shareholder approval at the next AGM, with books closing on Oct. 9, 2025.