At a Glance

- Coronation raises Aspen stake to 11.88 percent, showing confidence in Africa’s biggest drugmaker.

- Aspen faces $61.34 million annual loss after mRNA dispute, impairments, and restructuring costs.

- Investor appetite grows for South Africa’s healthcare and pharmaceutical sector despite Aspen’s headwinds.

Coronation Fund Managers (Coronation), one of South Africa’s largest asset managers, has boosted its stake in Aspen Pharmacare Holdings Limited, Africa’s biggest drugmaker, by 1.84 percent to 11.88 percent.

This latest investment reflects growing confidence in Aspen’s future despite recent financial setbacks and a bruising manufacturing dispute.

Coronation raises stake in Aspen

The latest increase, made through Coronation’s asset management arm, was disclosed in a regulatory filing released on Sept. 12. The move highlights the rising appetite among institutional investors for exposure to South Africa’s healthcare and pharmaceutical sectors.

Coronation’s purchase of an additional 1.84 percent of shares lifts its holding from 10.04 percent to 11.88 percent. The acquisition underlines Coronation’s confidence in Aspen’s position as Africa’s leading drugmaker and its potential for sustained growth in global pharmaceutical markets.

With this latest transaction, Coronation’s stake in Aspen is now worth R5.49 billion ($315.6 million)—cementing its influence in the pharmaceutical giant.

Aspen faces hurdles amid manufacturing dispute

Aspen Pharmacare Holdings, Africa’s largest pharmaceutical group, led by South African billionaire Stephen Saad, reported a net loss in its 2025 financial year, weighed down by impairments, restructuring charges, and a contractual dispute tied to mRNA manufacturing.

For the year ended June 30, 2025, Aspen swung to a loss of R1.08 billion ($61.34 million) from a profit of R4.4 billion ($249.36 million) a year earlier. The dispute, centered on its finished dose manufacturing business, also wiped more than R22 billion ($1.2 billion) off its market capitalization.

Coronation Fund Managers’ increased investment—backed by its management of over R582 billion ($31.7 billion) in assets—signals confidence in Aspen’s long-term resilience despite recent financial headwinds.

The move also underscores investor belief in the company’s strategic importance to Africa’s healthcare sector and its capacity to rebound from current challenges in manufacturing.

Brief history of Aspen Pharmacare detailed by Shore Africa

- Founded in 1997 by four (4) south African businessmen, including South Africa’s newest billionaire Stephen Saad, Gus Attridge, and Steve Sturlese.

- Aspen Pharmacare Holdings is renowned as Africa’s largest pharmaceutical group. Initially located in Durban, South Africa, it became listed on the JSE in 1998 by the backing from Investec.

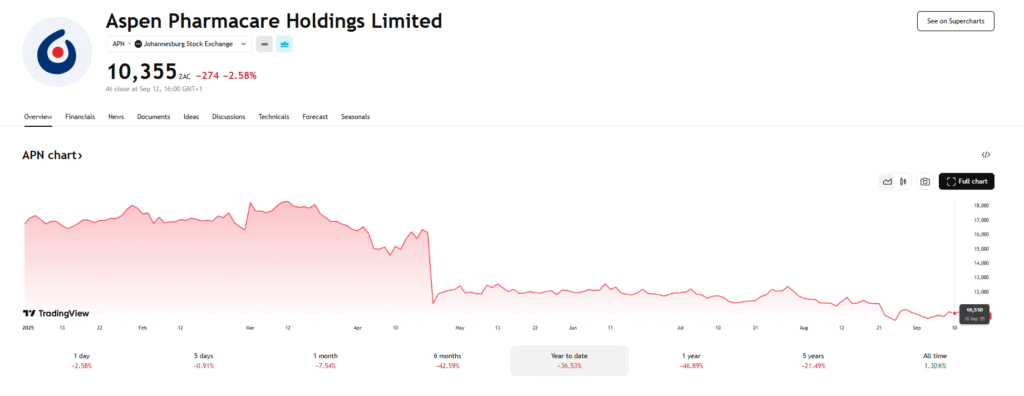

- The largest drug maker in Africa is currently valued at R46.2 billion ($2.66 billion) on the Johannesburg Stock Exchange (JSE):

- Aspen Pharmacare Holdings ranks as the 50th most valuable stock on the JSE, accounting for about 0.2 percent of Africa’s largest stock exchange, the Johannesburg stock exchange, based in Sandton.

- Business Analysis:

Those who bought Aspen shares at R164.85 ($9.49) at the start of the year, are currently be setback by roughly R61.3 ($3.53) per share today. This is attributed to a contractual dispute over manufacturing, including issues tied to mRNA technology, which Aspen, co-founded by Stephen Saad faced in 2025, erasing more than R22 billion ($1.2 billion) from the group’s market valuation. - The Fundamentals and performance in 2025:

For the year ended June 30, 2025, Aspen reported a loss of R1.08 billion ($61.34 million), compared with a profit of R4.4 billion ($249.36 million) the year before. This is first loss in 28 years, linked to a contractual dispute over manufacturing, including issues tied to mRNA technology, which also erased more than R22 billion ($1.2 billion) from the group’s market capitalization. - Dividends:

Well, Aspen Pharmacare managed to declare a cash dividend of R2.11 per ordinary share on September 3, 2025, for the year ended June 30, 2025, with a payment date of October 6, 2025. The dividend, which declined by 41.23 percent from the prior year’s R3.59 will be paid from the company’s income reserves.