At a Glance

- Hyprop’s revenue rose 8.9% to R6.9 billion ($397.46 million) as malls rebounded across key markets.

- Eastern European portfolio delivered 10.2% tenant turnover growth, lifting distributable income per share.

- Dividend payout increased 7.3% to R4.09 ($0.235) per share, rewarding shareholders with higher returns.

Hyprop Investments, the South African real estate investment trust (REIT) focused on dominant retail centers in South Africa and Eastern Europe, has projected up to 12 percent income growth for 2026, following the delivery of stronger results for the year ended June 30, 2025.

The $1.5 billion REIT boosts earnings as Eastern Europe drives growth, lifting revenue and dividends for 2025 while guiding a 10-12 percent income growth in 2026 in a move that underscores confidence in its retail portfolio.

Revenue climbs as malls rebound

According to its recent report, Revenue climbed 8.9 percent to R6.9 billion ($397.46 million) from R6.34 billion ($364.03 million) a year earlier, as South African retail assets recorded strong trading density growth and Eastern Europe malls benefited from resilient consumer demand.

Tenant turnover in South Africa grew 6.1 percent year on year, while Eastern Europe saw a 10.2 percent jump, underscoring the strength of its diversified portfolio.

As distributable income per share rose on the back of higher tenant turnover and rental growth the group, currently valued at R25.4 billion ($1.46 billion), reported a 7.3 percent increase in distributable income per share to R4.09 ($0.235), up from R3.81 ($0.219) in 2024, supported by robust portfolio performance and lower funding costs.

Dividend lifted, shareholders rewarded, and balance sheet strengthened

Net asset value per share increased 6.2 percent to R94.67 ($5.46), while group loan-to-value declined to 33.8 percent from 36.3 percent, reflecting disciplined debt management. Retained earnings also improved, with cash generation boosted by strong rental collections and reduced interest expenses.

Hyprop declared a final dividend of R2.20 ($0.127) per share, taking the full-year payout to R4.09 ($0.235) — 7.3 percent higher than last year. The board also guided for a 6 to 8 percent rise in distributable income per share for fiscal 2026, signaling confidence in sustained demand across its markets.

Eastern Europe expansion cushions local headwinds

The group’s Eastern European portfolio, including properties in Bulgaria, Croatia, and Serbia, now contributes more than a third of total distributable income.

Management said new developments and refurbishments in Sofia and Belgrade are expected to lift long-term growth, even as South African load-shedding and muted economic activity weigh on local operations.

Hyprop said it will continue focusing on dominant regional shopping centers, renewable energy investment, and selective expansion in Eastern Europe. The company expects further recovery in footfall and tenant sales, while cost savings from energy efficiency projects should support margins.

Brief about Hyprop Investments Plc

1. Brief history:

Hyprop Investments Limited is one of South Africa’s leading retail-focused real estate investment trusts (REITs). It owns and manages shopping centers in key South African metros, parts of sub-Saharan Africa, and Eastern Europe.

In Nigeria, Hyprop became widely known during the EndSARS protests when Ikeja City Mall, a flagship asset, was vandalized. The company had acquired a 75 percent stake in the mall from Actis in November 2015 for $115 million, but later sold it in November 2021. Ikeja City Mall was valued at $113 million in June 2024, down from $128 million a year earlier.

2. Market valuation:

Hyprop’s market capitalization on the Johannesburg Stock Exchange (JSE) stands at R19 billion ($1.09 billion).

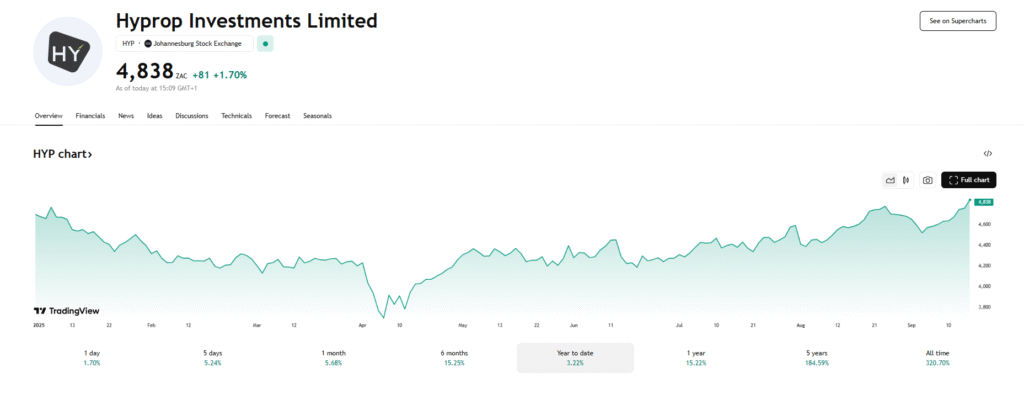

3. Stock performance:

Hyprop ranks as the 85th most valuable stock on the JSE, representing about 0.09 percent of the exchange. Investors who bought shares at R46.99 ($2.71) at the start of 2025 have gained about R1.40 ($0.081) per share. Those who entered during the April 7 dip at R37 ($2.14) are up R11.39 ($0.66).

4. Expansion:

In mid-July, Hyprop launched a voluntary $824.3 million offer to acquire a controlling stake in MAS Plc., a property investor and operator also listed on the JSE