At a Glance

- Angola offers to buy Anglo American’s 85% De Beers stake, challenging Botswana’s ownership ambitions.

- Angola overtakes Botswana as Africa’s top diamond producer, signaling a regional power shift.

- The deal could reshape the global diamond supply chain and boost Angola’s mining and export strength.

Angola has formally offered to buy Anglo American Plc’s controlling stake in De Beers Group, entering a high-stakes contest that includes rival interest from neighboring Botswana.

State-owned diamond company Endiama EP submitted what Chief Executive Officer José Manuel Ganga Júnior described as “a concrete and well-defined proposal” to Anglo American.

Speaking in Luanda, he said discussions were underway but declined to share specific terms, citing confidentiality agreements.

Anglo American currently holds an 85% share in De Beers, while Botswana owns the remaining 15%. Botswana’s government, led by President Mokgweetsi Masisi, has made clear its intention to increase that stake, calling the move “a matter of economic sovereignty.”

Ganga Júnior said Endiama was confident both countries could reach “a mutual understanding” on their competing interests.

He noted that Angola’s bid is motivated not only by commercial ambition but also by a desire to access De Beers’ advanced mining technologies and global marketing systems — assets that could strengthen Angola’s fast-rising diamond sector.

Diamond power shift in Africa

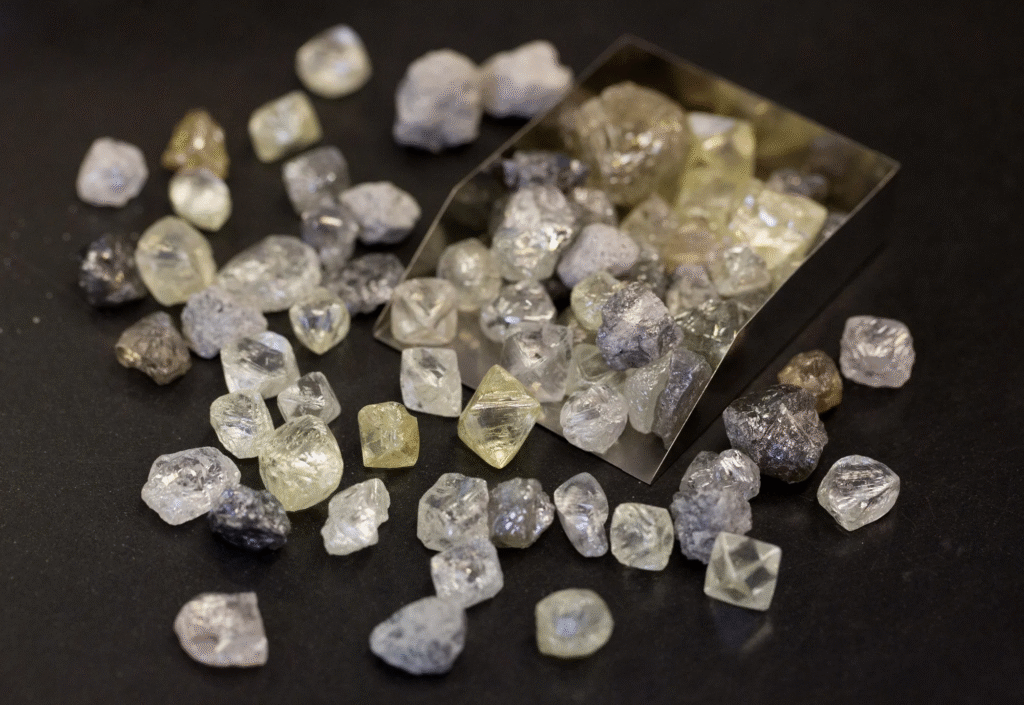

Angola’s offer comes amid a major shift in the continent’s diamond industry. For the first time in two decades, the country has overtaken Botswana as Africa’s top diamond producer by value, according to the latest data from the Kimberley Process.

The change reflects more than just higher output. It underscores Angola’s ability to extract higher-quality stones from deposits that were once underdeveloped because of limited technology and infrastructure.

Recent figures show Angola leading in value terms, ending Botswana’s roughly 20-year dominance.

Industry analysts say this is the most significant reshaping of Africa’s diamond hierarchy since the early 2000s.

The timing of Angola’s bid suggests confidence that its improved production profile strengthens its bargaining position in talks with Anglo American.

Strategic stakes and global implications

Ganga Júnior said the deal could mark a turning point for Angola’s mining industry, enabling it to leapfrog decades of incremental progress by adopting De Beers’ expertise in exploration, extraction, and global sales.

De Beers, founded in 1888, remains a cornerstone of the global diamond market, with operations in Botswana, Namibia, South Africa, and Canada. Its parent company, Anglo American, established in 1917 is one of the world’s most diversified miners, with assets in platinum, copper, nickel, iron ore, and diamonds.

Since Duncan Wanblad became CEO in 2022, Anglo American has been undergoing a broad restructuring aimed at focusing on core operations.

Earlier this year, the London-based miner confirmed it was exploring options to either list or sell De Beers, a move that could reshape ownership across the global diamond supply chain.

For Angola, securing control of De Beers would not only mark a symbolic win but also cement its status as a leading force in the international diamond market — one increasingly defined by African producers themselves.