At a Glance

- Algeria, Libya and Egypt dominate Africa’s official gold reserves held by central banks.

- Gold reserves help African economies hedge inflation, currency volatility and external shocks.

- Smaller economies hold gold as insurance against geopolitical and global financial risks.

Africa’s biggest gold reserves are quietly shaping the continent’s financial resilience, sitting inside central bank vaults as protection against inflation, currency swings and global shocks.

While Africa is widely known for gold production, led by Ghana and South Africa, the size of official gold reserves tells a different story about monetary strength.

From Algeria and Libya to Egypt and South Africa, central banks use gold as a strategic anchor, reinforcing balance sheets, stabilizing currencies and strengthening investor confidence.

Across North and Sub-Saharan Africa, central banks have accumulated gold not as a speculative play, but as an anchor of monetary credibility.

In recent years, renewed global uncertainty, rising interest rates, and currency swings have reinforced gold’s role in reserve management.

From Algeria and Libya, whose large holdings reflect decades of conservative reserve policy, to Egypt’s steady accumulation alongside economic reforms, Africa’s gold map is both diverse and strategic. Smaller economies such as Mauritius and Morocco use gold as insurance, while frontier markets like Mozambique and Kenya hold modest amounts that nonetheless signal long-term intent.

Here are the 10 African countries profiled by Shore Africa with the biggest official gold reserves—and how each uses the precious metal to underpin economic stability.

1. Algeria — 173.56 tonnes

Algeria holds Africa’s largest gold reserves, reflecting a long-standing conservative monetary strategy. Gold plays a central role in preserving foreign reserves, supporting the dinar, and shielding the economy from oil price volatility and external shocks.

2. Libya — 146.65 tonnes

Libya’s substantial gold stockpile serves as a financial buffer amid political instability. The reserves help protect against inflation, support monetary credibility, and provide a safeguard for future economic reconstruction efforts.

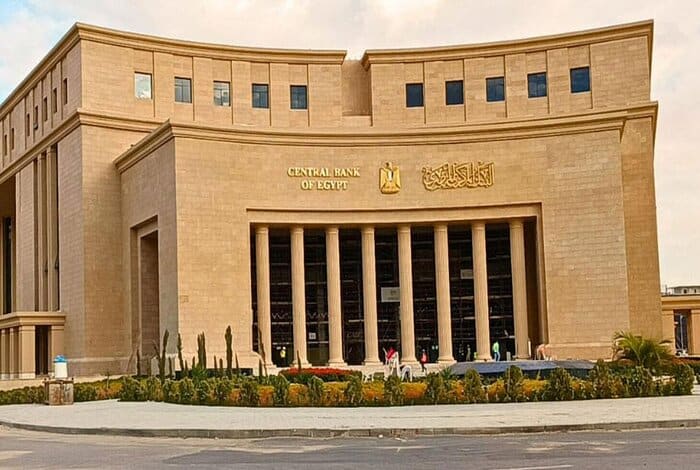

3. Egypt — 128.54 tonnes

Egypt has steadily built its gold reserves as part of broader economic reforms. The holdings support currency stability, strengthen investor confidence, and complement foreign exchange reserves during periods of fiscal and external pressure.

4. South Africa — 125 tonnes

Despite being Africa’s leading gold producer historically, South Africa maintains moderate official reserves. Gold functions primarily as a store of value, supporting financial stability rather than acting as a dominant reserve asset.

5. Ghana — 32.99 tonnes

Ghana has expanded its gold reserves in recent years, aligning holdings with its status as Africa’s top gold producer. The strategy enhances financial security and supports currency management amid debt and inflation challenges.

6. Morocco — 22.12 tonnes

Morocco leverages gold as a stabilising asset within a diversified reserve portfolio. The holdings help reinforce confidence in the financial system and provide insurance against external economic volatility.

7. Mauritius — 12.42 tonnes

Mauritius uses gold as a defensive asset to protect its open, services-driven economy. The reserves act as a hedge against global downturns and financial market disruptions.