At a Glance

- Al Mana invests $200 million in Egypt SAF plant at Suez Canal Economic Zone.

- The plant targets 200,000 tons annually using used cooking oil feedstock.

- Shell signs long-term offtake; operations expected by end-2027.

Qatar’s Al Mana Holding is stepping into Egypt’s clean energy and aviation supply chain with a $200 million investment to build a sustainable aviation fuel production facility in the Suez Canal Economic Zone, marking its first industrial project in the strategic corridor.

The agreement reflects Egypt’s growing appeal as a base for renewable fuel manufacturing as airlines and energy companies accelerate efforts to cut emissions. It also signals deeper economic ties between Cairo and Doha at a time when both governments are encouraging private-sector investment.

The plant will be developed by Saf Fly Limited, a newly established company backed by Al Mana Holding. Once operational, the facility is expected to produce up to 200,000 metric tons a year of sustainable aviation fuel, along with BioPropane and Bio Naphtha.

The fuel will be made from refined used cooking oil, a feedstock increasingly favored by producers seeking lower-carbon alternatives to conventional jet fuel.

Long-term supply agreement with Shell

Al Mana has secured a long-term offtake agreement with Shell, which will purchase the full output of the plant when production begins. Operations are scheduled to start by the end of 2027, providing the project with predictable demand and stable revenue from the outset.

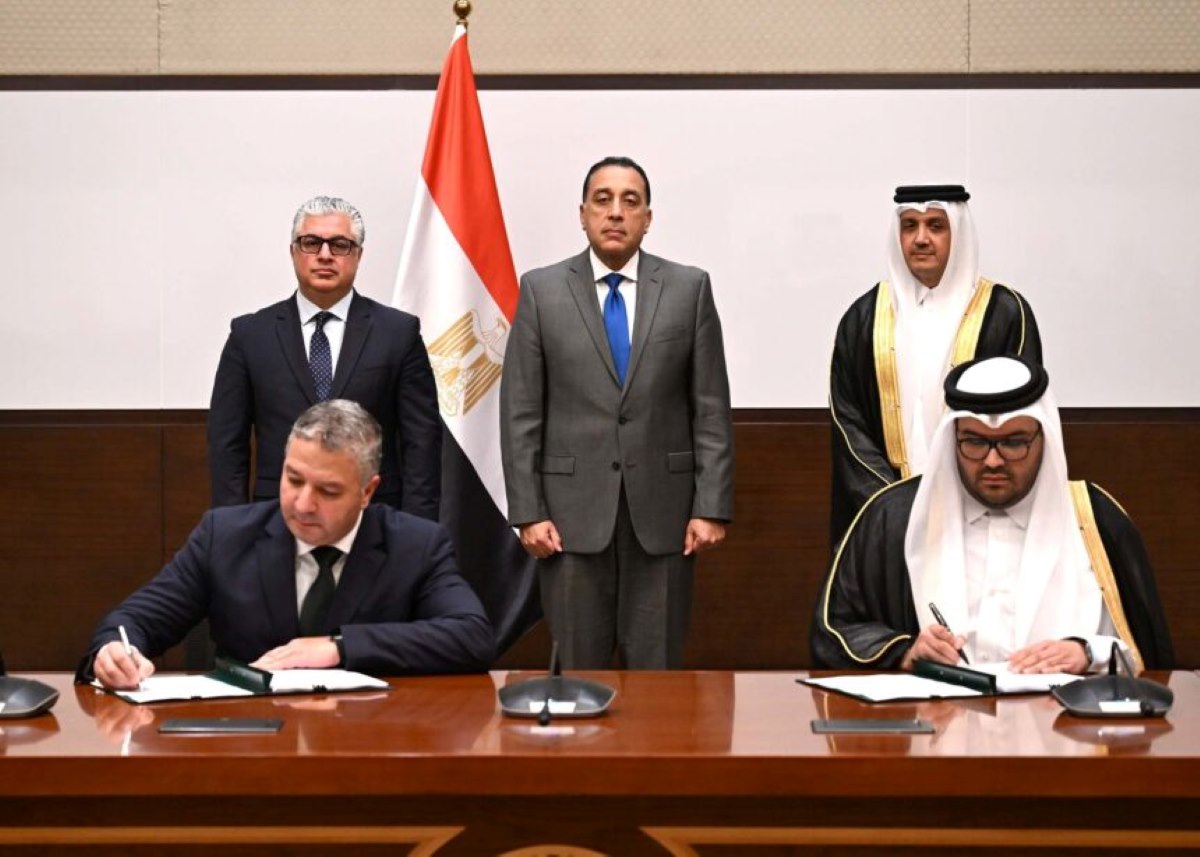

The agreement was signed by Captain Ahmed Gamal, vice chairperson of the Southern Zone at the Suez Canal Economic Zone, and Saad Mohammed Al Mana, a board member of Al Mana Holding. Egyptian Prime Minister Mostafa Madbouly witnessed the signing during an event at the New Administrative Capital.

Madbouly said the project supports Egypt’s push to attract investments tied to renewable energy and cleaner fuels while helping the aviation sector align with international environmental requirements. The signing coincided with the Egyptian-Qatari Business Forum in Cairo, highlighting renewed business engagement between the two countries.

Strategic location at Sokhna

The facility will be built in the Sokhna Integrated Zone, covering about 100,000 square meters. Roughly 70,000 square meters will sit within the industrial area, with the remaining 30,000 square meters located at Sokhna Port.

The investment, valued at about 9.6 billion Egyptian pounds, will benefit from the zone’s combined industrial and logistics infrastructure, allowing raw materials to be imported efficiently and finished products to be shipped to global markets.

Walid Gamal El-Din, chairperson of the Suez Canal Economic Zone, said environmental considerations are a key part of the zone’s investment strategy. He said the project is expected to reduce emissions by between 50% and 80% compared with traditional aviation fuel, making it attractive to airlines and energy buyers under pressure to meet climate targets.

Abdulaziz Al Mana, chief executive of Al Mana Holding and chairman of Green Sky Capital, said the project reflects confidence in Egypt’s regulatory framework and investment climate. He pointed to political support from both Egypt and Qatar as an important factor in advancing cross-border projects in renewable energy and aviation fuel.

Founded in 1952, Al Mana Holding operates more than 55 companies and over 300 outlets across eight countries. The group represents a range of global brands and has increasingly turned its focus toward sustainable energy, with the Egypt project serving as a key step in its expanding clean fuel portfolio.