At a Glance

- Capitec’s effective tax rate rose as AvaFin integration expanded taxable income streams.

- Profit after tax climbed over 30% despite sharply higher income and deferred tax charges.

- Insurance income on Capitec’s licence boosted revenue while reshaping tax reporting lines.

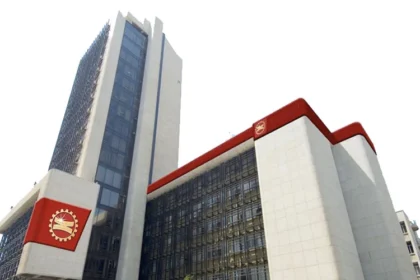

Capitec Bank, the South African retail lender co-founded by billionaire banker Michiel le Roux, has reported paying R3.99 billion ($238.23 million) in income and deferred tax in the 2025 financial year, a sharp rise that mirrors the bank’s strong profit growth and expanding income base.

Management attributed the increase mainly to the integration of AvaFin and the growing contribution from income earned under Capitec’s own insurance licence.

AvaFin integration fuels higher tax bill

The tax charge increased 39 percent from R2.9 billion ($172.75 million) a year earlier, lifting the group’s effective tax rate to 22.5 percent, up from 21.4 percent in 2024.

AvaFin added R62 million ($3.7 million) to the tax expense at an effective rate of 23.5 percent, while insurance income earned directly on Capitec’s licence attracted tax within the group’s tax line.

By contrast, tax on income generated through insurance cell captives is reflected in net insurance results. The disclosure difference had no impact on profit after tax. On a stand-alone basis, Capitec Bank Limited recorded an effective tax rate of 26.7 percent.

Capitec’s profitability strengthened amid higher tax bill

Despite the higher tax bill, profitability strengthened markedly. Profit after tax climbed 30.11 percent to R13.75 billion ($742.5 million) from R10.57 billion ($570.6 million) in 2024, underlining the bank’s ability to scale earnings while maintaining cost discipline.

The performance was driven by broad-based income growth. Net interest income rose 17.14 percent to R30.23 billion ($1.63 billion), supported by a 16.78-percent increase in lending-related interest income. Investment income also improved, rising 17.97 percent to R8.99 billion ($483.9 million).

Non-interest income expanded even faster, climbing 21.98 percent to R23.88 billion ($1.29 billion). Transaction and commission income led the increase, surging 25.35 percent to R18.54 billion ($998 million), while Capitec Connect more than doubled its contribution year-on-year.

Lower credit losses further strengthened earnings. Impairments declined 5.35 percent to R8.26 billion ($444 million), lifting net interest income after impairments by more than 54 percent to R11.93 billion ($642.6 million).