At a Glance

- Lighthouse secures $22.6 million to support expansion in Europe and Africa real estate markets.

- Oversubscribed offering signals confidence in Lighthouse’s asset strategy and income diversification.

- Iberia to comprise 86% of Lighthouse’s $1.23 billion direct property portfolio by year-end.

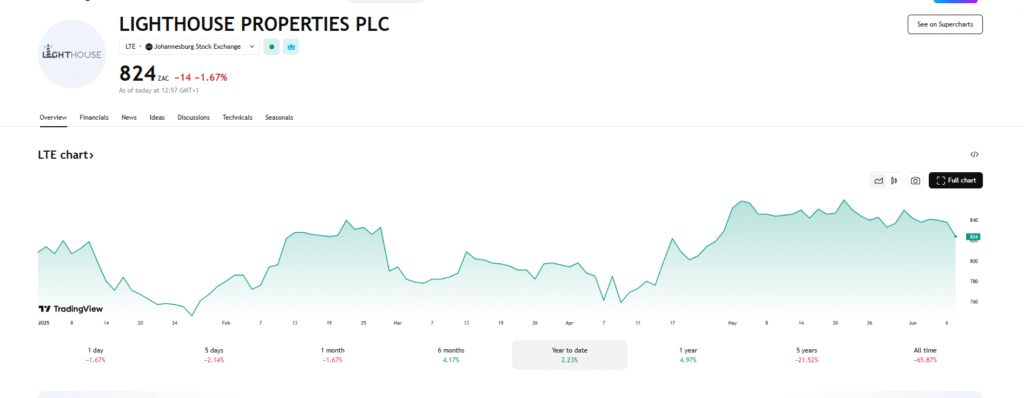

Lighthouse Properties, the Malta-based real estate firm led by South African businessman Desmond de Beer, has raised R400 million ($22.6 million) through an oversubscribed rights issue—marking a significant milestone for the Mauritius-incorporated REIT amid a high-interest-rate environment.

Strong investor demand underscores market confidence

Initially targeting a smaller raise, Lighthouse expanded the size of its equity offering following strong investor interest.

Priced at R8.20 ($0.463) per share, the R400 million ($22.59 million) issue attracted robust demand, leading to the early closure of the offer and the issuance of 48.78 million new shares.

Pending Johannesburg Stock Exchange (JSE) approval, the new shares are expected to begin trading at 9:00 a.m. on Wednesday, June 18, 2025.

Following the issuance, Lighthouse’s total share capital will increase from 2.02 billion shares to over 2.09 billion shares. The oversubscription signals deep investor confidence in the company’s asset strategy, operational resilience, and income diversification across geographies.

Strengthened balance sheet to support expansion

In light of strong demand, Lighthouse has confirmed it will increase the equity further by additional R300 million ($16.92 million). The fresh capital will bolster its balance sheet and support its acquisition pipeline as the company hunts for high-yield opportunities in a fragmented global real estate market.

Lighthouse, which focuses on retail-led real estate in Europe and Africa, is ramping up its presence in the Iberian Peninsula.

By year-end, Iberia is expected to account for 86 percent of Lighthouse’s €1.14 billion ($1.23 billion) direct property portfolio, bolstered by the March 2025 acquisition of Alcalá Magna and an additional Spanish mall expected to close in June following a February exclusivity agreement.

The company’s portfolio includes high-footfall retail centres anchored by brands like Primark and Zara, benefiting from consolidation in the sector and improving sales metrics.

Stuhler’s strategy continues to deliver

Under the leadership of Desmond de Beer, Lighthouse has evolved from Lighthouse Capital Limited into a more focused REIT with direct real estate investments. Its disciplined capital deployment and cross-border asset diversification have helped distinguish the company in a competitive JSE REIT space.

The success of this rights issue signals investor alignment with the firm’s long-term strategy and validates management’s execution. It also reinforces Lighthouse’s ability to tap capital markets in volatile conditions—an advantage as it continues to seek growth in Europe’s high-yield retail property segment.