At a Glance

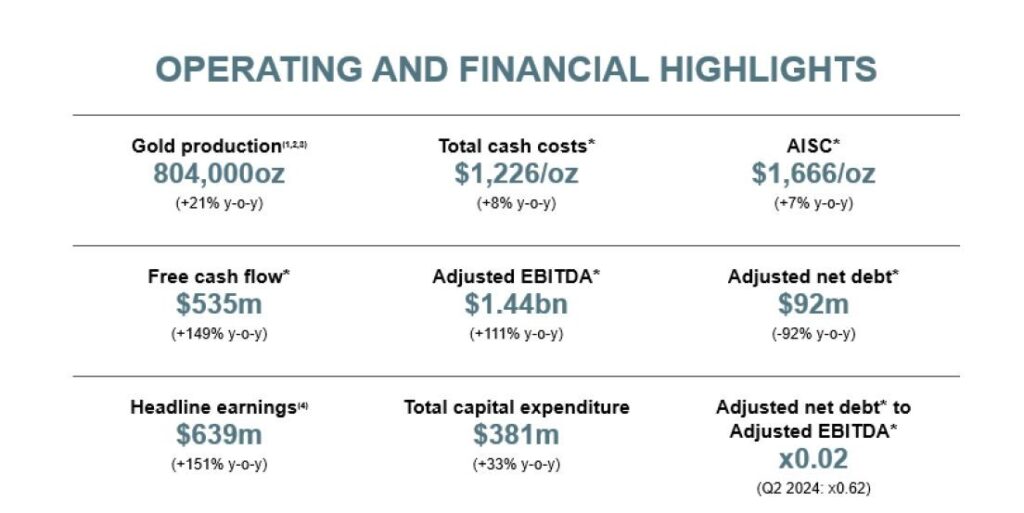

- Gold production jumped 21% in Q2 2025 to 804,000 ounces, led by Obuasi, Geita, and Egypt’s newly acquired Sukari mine.

- Free cash flow surged 149% to $535 million, allowing a dividend boost and trimming net debt 92% to just $92 million.

- Adjusted EBITDA more than doubled to $1.44 billion, as higher prices and cost discipline bolstered profitability across key assets.

AngloGold Ashanti Plc reported strong earnings and cash generation in the second quarter of 2025, driven by a sharp increase in gold prices and production gains across core assets. The group posted headline earnings of $1.09 billion, reflecting broad-based operational gains and disciplined capital management.

The company also adjusted EBITDA of $1.44 billion in the three months to June, more than double the $684 million reported a year earlier, while headline profit rose 151 percent to $639 million.

Cash gushes, debt drops as gold price lifts earnings

According to its recently released half-year report, headline earnings climbed by 247.28 percent to $1.09 billion compared to $313 million in the same period last year.

The strong result reflected a 21 percent jump in gold production to 804,000 ounces and a 41 percent spike in the average price received per ounce to $3,287. Obuasi in Ghana and Geita in Tanzania led the gains, alongside the newly added Sukari in Egypt.

Free cash flow in Q2 rose 149 percent to $535 million, up from $215 million in the same period last year, allowing the company to declare an interim dividend of 80 cents per share—well above its base payout of 12.5 cents. Net cash from operating activities jumped 142 percent year-on-year to $1.02 billion.

Shore Africa unveiled that AngloGold also used the inflow to reduce its adjusted net debt to $92 million from $1.16 billion in Q2 2024, improving its net debt to EBITDA ratio to just 0.02x.

Liquidity remained robust at $3.4 billion, including $2 billion in cash reserves. “We’re reaping the benefit of consistent production and cash flow growth,” said CEO Alberto Calderon. “This result reflects our disciplined capital allocation and continued progress across the portfolio.”

Production gains spread across key assets

Managed operations delivered 729,000 ounces of gold in Q2, up 25 percent from a year earlier, supported by strong recoveries at Obuasi and Geita and steady output from Cerro Vanguardia, Cuiabá, and Siguiri. Obuasi’s output climbed 31 percent year-on-year, with higher grades from its underhand drift-and-fill mining ramp-up.

Group total cash costs rose 8 percent to $1,226/oz, while all-in sustaining costs (AISC) increased 7 percent to $1,666/oz, largely due to higher sustaining capital and royalty charges.

Despite inflationary pressures and a 28 percent jump in sustaining capex, real-term AISC remained relatively flat for managed operations.

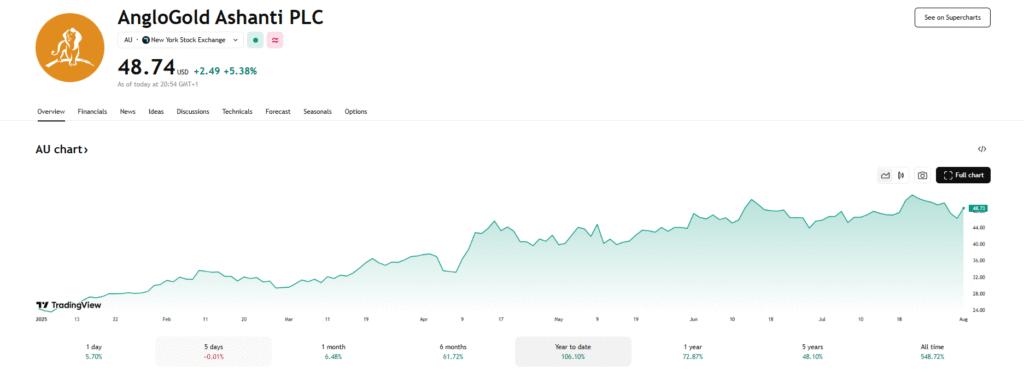

US listing gains traction as liquidity deepens

Following its primary listing on the NYSE in late 2023, AngloGold Ashanti secured inclusion in the Russell 1000®, 3000®, and Midcap® Indexes in June 2025, a move expected to attract more US institutional investors and improve stock liquidity.

Portfolio shift, Brazil exit and US expansion underway

AngloGold continues to reshape its global footprint. It sold projects in Côte d’Ivoire and plans to exit the Serra Grande mine in Brazil.

Meanwhile, the proposed acquisition of Augusta Gold strengthens its presence in the Beatty District in Nevada—described by the company as the most significant emerging gold hub in the US.

Guidance reaffirmed as outlook remains strong

AngloGold maintained its full-year 2025 guidance, citing steady progress on mine life extensions, margin enhancements, and capital discipline.

With net debt sharply reduced and operations firing across regions, the group is well-positioned to build on its H1 momentum through the rest of the year.