At a Glance

- Inflation’s uneven retreat is splitting African economies between recovery and strain.

- Consumers are cutting back on luxuries, shifting to essentials and informal markets.

- Weaker currencies and high borrowing costs are squeezing businesses and households alike.

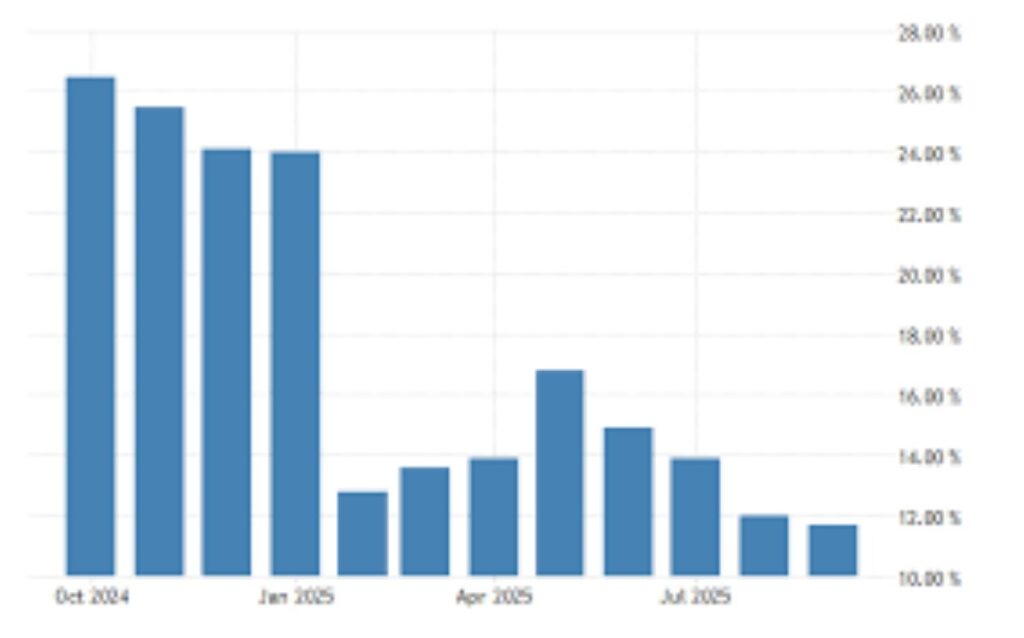

Across major African markets, inflation’s retreat from its 2022–2023 highs has been uneven. While Kenya, Ghana and South Africa have seen price pressures ease, others, including Nigeria and Egypt, continue to wrestle with double-digit inflation.

The result is a split economy, one where households are adjusting spending habits, prioritizing essentials over luxuries, and turning more to informal and digital marketplaces. These shifts are quietly redefining how growth takes shape across the continent in 2025.

A two-speed recovery

By mid-2024, several African countries began showing signs of relief, but the pace of recovery varies widely. In lower-inflation markets, cooling prices are helping restore consumer confidence and lifting retail demand for goods such as clothing, appliances and smartphones.

In high-inflation nations, spending remains concentrated on food, fuel and transportation—the staples that dominate most household budgets.

For investors and policymakers, this divide highlights a key reality: Africa’s inflation story isn’t uniform. Each economy is moving on its own path, requiring tailored strategies and nimble pricing decisions.

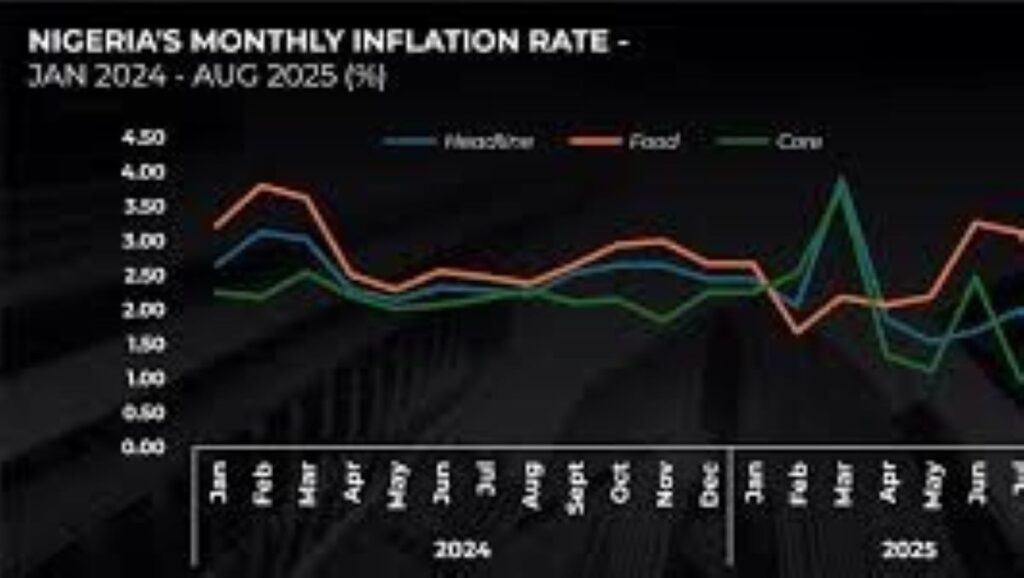

Food prices still bite

For many African families, food remains the clearest indicator of inflation. When grain, cooking oil or fuel prices rise, spending on everything else drops sharply.

Retail data from Nigeria, Ethiopia and Egypt show that food and beverage spending continues to grow faster than purchases of durable goods. This trend has boosted neighborhood markets and street vendors, often at the expense of larger retail chains.

Currency pressure and the cost of living

Depreciating currencies have deepened the strain in several countries by pushing up import prices.

Urban consumers with access to foreign currency or credit cards have more room to manage, but rural and low-income households are scaling back—buying smaller packs and cheaper substitutes.

For companies, these patterns raise new challenges. Weaker currencies and volatile import costs complicate inventory planning, while foreign exchange losses cut into margins and delay expansion plans.

Credit, interest rates, and the cost of borrowing

High interest rates, kept in place by central banks to contain inflation, have slowed big-ticket purchases such as vehicles and real estate.

At the same time, short-term lending options like microcredit and buy-now-pay-later programs are expanding, giving consumers temporary relief but increasing household debt risks.

Fintech companies that focus on responsible lending and sound risk models are gaining ground, while those chasing rapid growth face higher default rates.

Remittances and subsidies offer some relief

Remittances from abroad remain a crucial buffer for millions of households, helping sustain consumption despite rising costs.

Governments have also rolled out targeted subsidies for food and fuel, offering short-term relief but putting added pressure on public finances. Balancing these social needs with fiscal discipline will shape policy choices across 2025.

What lies ahead

For consumer goods companies, adaptability is becoming a competitive advantage. Brands are downsizing product packs, expanding online and informal retail networks, and sourcing more inputs locally to manage supply chain risks.

Central banks, meanwhile, must balance between encouraging growth and keeping inflation in check. Cutting rates too soon could reignite price pressures, while staying tight too long could weaken fragile recoveries.

Africa’s inflation challenge is no longer a temporary phase—it’s reshaping spending habits, business models and policy priorities.

The countries that turn this adjustment into stronger local production, smarter safety nets and better fiscal management will be the ones to emerge stronger in the years ahead.