At a Glance

- FMB Capital’s pre-tax profit rose 11%, driving a 7% increase in taxes paid.

- Total assets surged 36% to $2.07 billion, reflecting strong regional expansion.

- Malawi, Mozambique, Botswana, Zimbabwe drive diversified earnings across Southern Africa footprint.

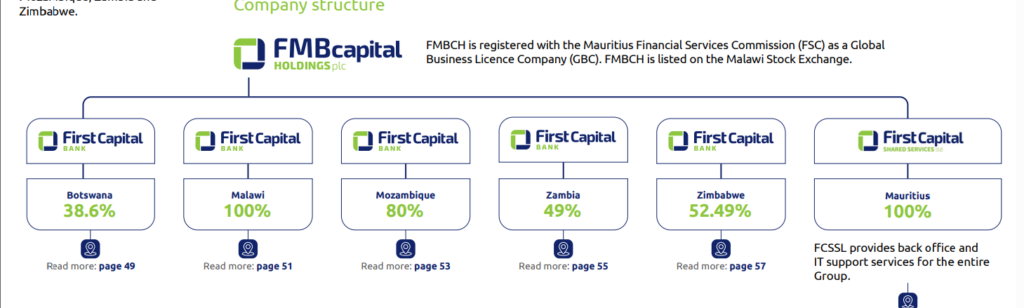

Mauritius-based financial services group FMB Capital Holdings Plc has reported paying $42.3 million in income taxes across its operating countries in 2024, reflecting strong earnings growth and a robust regional presence.

According to the group’s annual financial statements, net interest income rose to $166.5 million in 2024 from $136 million in 2023, driven by higher loans and advances and a sharp increase in customer deposits.

Total operating income climbed to $278.3 million, while profit after tax increased 12.8 percent to $103.5 million.

The group’s pre-tax profit rose 11 percent to $145.8 million, underpinning the 7 percent increase in taxes paid year-on-year. Total comprehensive income for the year surged to $108.3 million, more than doubling from the $40.3 million recorded in 2023.

Balance-sheet expansion and regional performance

FMB Capital’s balance sheet strengthened markedly in 2024, with total assets growing 36 percent to $2.07 billion from $1.52 billion a year earlier.

Loans and advances increased to $772.2 million, while customer deposits jumped to $1.51 billion. Retained earnings rose 35 percent to $186.2 million, highlighting the group’s improving capital position.

Regionally, Malawi remained the largest contributor to profit after tax at $27.4 million, followed by Mozambique ($26.1 million), Botswana ($24.1 million), and Zimbabwe ($23.3 million), reflecting a diversified earnings base across the group’s Southern African footprint.

Strong governance and workforce development

The group maintained a workforce of 2,031 employees, with 50.5 percent female staff and nearly half under 35, supported by graduate programmes in Botswana, Malawi, Mozambique, and Zambia.

Governance remained robust, with 98 percent board meeting attendance and a clear separation between executive and non-executive roles. Compliance was strong across all markets, with no fines and only one immaterial penalty in Zimbabwe.

Expansion and outlook

Founded in 1995 and led by Malawian businessman Hitesh Anadkat, who owns a 45.32 percent stake, FMB Capital continues to expand its footprint across Southern Africa.

The group’s centralized shared services model for technology, finance, risk, compliance, audit, and HR has enhanced execution at country level, allowing teams to focus on customer outcomes while drawing on Group-wide expertise.

The 2024 results underscore steady execution across the group, with earnings growth, stronger capital buffers, and expanding customer balances positioning FMB Capital to navigate macroeconomic pressures while pursuing continued regional growth.